Good News in Tough Times

By | November 2, 2010

CTHRA has released the results of its annual Human Capital Metrics Survey, and the findings reflect well on our industry. The survey results show that in a year when revenue, employment and other performance indicators plummeted for most U.S. organizations, the cable and telecommunications industry’s results remained stable and even improved in some cases. Most notably, productivity, average net income per company and employee tenure all increased dramatically, while voluntary turnover was markedly lower compared with companies in other industries.

Methodology

The survey was conducted by the Society for Human Resource Management in March 2010. Thirteen companies solely within the cable and telecommunications industry participated by submitting data based on 2009 performance. The operator participants were AETN, Bright House Networks, Cablevision, Comcast Cable, Cox Communications, C-SPAN, Discovery Communications, ESPN, Rogers Communications, Scripps Networks, Starz Entertainment, Time Warner Cable and Turner Broadcasting System.

The collected data were compared to the SHRM Human Capital Benchmarking Database which consists of more than 3,000 organizations. Because the average number of employees among CTHRA’s survey participants was 8,023, comparisons were made to SHRM’s category of large-staff-sized organizations from all industries combined. By controlling for organizational size, comparisons can then be made based on unique business drivers and human capital metrics related to the cable and telecommunications industry.

Dramatic Increases in Productivity

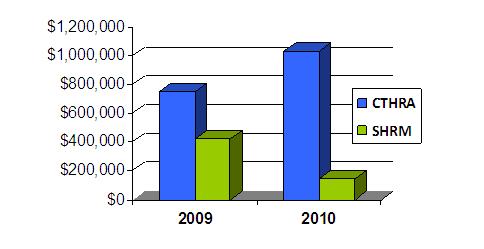

CTHRA’s survey determined that average revenue per FTE was $1,028,944, up 37% from the previous year (see Figure 1). Average net income per FTE also jumped 34% to $424,566. These productivity increases stand in contrast to results in the SHRM category of large organizations, which dropped precipitously in 2009. For the SHRM category, average revenue per FTE dropped 66% to $143,223, while average net income per FTE fell 92% to $4,722.

Figure 1: Average Revenue per FTE

Turnover and Tenure

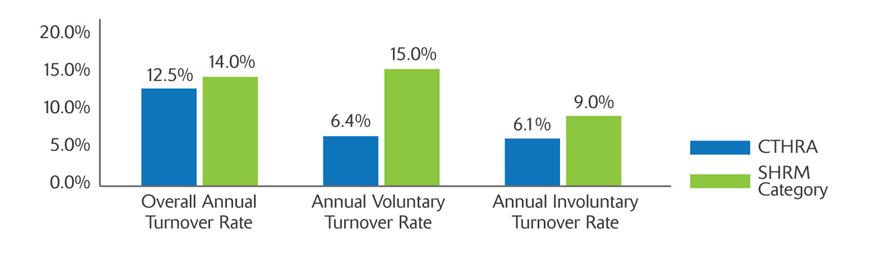

Turnover rate was the most important metric cited by CTHRA’s survey participants—an indication that retaining key talent is seen as critical to organizational success. Although there was a negligible 0.5% increase for annual involuntary turnover rates from CTHRA’s 2009 survey findings to its 2010 results, voluntary turnover decreased in every job category (see Figure 2). While some employees may have chosen to stay simply because they had fewer job options outside of the organization, it is likely that seeing friends and family members in other industries lose their jobs, cable industry employees may have gained renewed appreciation for their organizations’ financial stability and their firms’ leadership practices to achieve it.

Average CTHRA overall annual turnover rate, which reflects both voluntary and involuntary turnover, dropped from 15.7% to 12.5% and was slightly lower than the SHRM category average overall turnover rate of 14%. The average voluntary turnover rate dropped to 6.4% from 10.2% the previous year. Compared with the SHRM category average voluntary turnover rate of 15%, CTHRA‘s rate of 6.4% was low.

Figure 2: Average Annual Turnover Rates

The average employee tenure for CTHRA participants has steadily increased. In CTHRA’s 2010 survey, the average employee turnover was 7.0 years, up from 6.3 years in 2009 and 5.8 years in the 2008.

Hiring Trends

The low turnover rate undoubtedly contributed to hiring practices among cable companies last year. CTHRA’s survey participants hired an average of 3,566 new employees in 2009, representing a 33% decrease from the previous year. The reason for the hiring decline is simple: Employee retention, combined with increased organizational productivity, as evidenced by higher revenue per FTE and net income per FTE, simply reduced the need for additional staff.

Even with the lower rates, CTHRA’s overall hiring far outpaced the SHRM category, where overall average number of hires was 849. The average CTHRA’s internal hire rate was 33% in 2009, reflecting a 4.8% decrease from the prior year. With millions of highly skilled workers still unemployed, the decrease in the rate of internal hires suggests that when positions opened, internal candidates faced greater competition from strong external candidates. The obvious lesson to be learned for employees: Do everything you can to boost your value and your profile in the company, including taking full advantage of perks such as tuition-assistance programs, work-related seminars and conferences, as well as on-the-job training opportunities.

Another word to wise job seekers, both internal and external, appears in the form of two more survey hiring figures: While average cost per hire (CPH) dropped $566 for CTHRA participants and $408 for the corresponding SHRM category over the prior year, the cable and telecommunications industry still continued to invest more in hiring than its counterparts. The average CPH was $4,055 for CTHRA participants and $3,553 for similarly sized companies across industries in SHRM’s database (see Figure 3).

Figure 3

|

|

2009

CTHRA

Survey Findings for

Cable Orgs

|

2010

CTHRA

Survey

Findings for Cable Orgs

|

2010

SHRM Cross-Industry

Statistics for

Large-staff Orgs

|

|

Cost Per Hire (CPH)

|

$4,621

|

$4,055

|

$3,553

|

|

Time To Fill a Position

|

50 days

|

49 days

|

40 days

|

The average time-to-fill metric decreased by one day from the previous year’s findings, suggesting that hiring managers took time to selectively interview candidates and did not rush to hire, even though the economic downturn created large pools of qualified talent.

Putting the Numbers to Work

CTHRA’s 2010 survey results establish industry-specific benchmarks for human capital and organizational metrics that are not available elsewhere, and savvy HR execs use the findings as a vital tool for strategic decision-making. Said John Fries, senior manager of human capital analysis and planning for Time Warner Cable: “Human capital metrics in general are playing an increasingly significant role in support of decision making within our organization in areas such as compensation and talent retention. In particular, the CTHRA human capital metrics survey provides us with a valued external benchmark for voluntary and involuntary turnover, as the metrics provide performance indicators for the company relative to industry norms.”

More and more, CTHRA’S survey results are playing a role beyond the HR department. John Dooney, SHRM’s manager of strategic research, said that throughout a corporation, “benchmarking data helps managers compare their organization against their competitors so they can focus resources on areas that might warrant improvement, or the comparison figures can protect areas or programs that are performing well. For instance, in one company, corporate management thought recruiting costs should be much lower than they were, but based on benchmarking data, HR executives were able to show that lowering recruiting costs below those of their competitors could actually jeopardize their firm’s ability to find the right talent to compete in the market.”

Dooney cautioned, though, that the key to success is to use survey data wisely. Because companies differ in their overall business strategy, location, size and other factors, any two companies can be well-managed, yet some of their human capital measures may differ greatly. Human capital metrics should always be considered within the context of the business strategy and tactics of the individual organization.

(Pamela Williams, CAE is Executive Director of the Cable and Telecommunications Human Resources Association).