An Energy Policy For Cable Operators: Import More Revenue

Operators are busy developing services and architectures aligned with trends in consumer expectations, online activities and social-networking behaviors. At the heart of these initiatives is the creation of converged experiences that integrate the consumer’s most valued media – premium video content – with the Web, device, social and app-enabled activity now part of their everyday interconnected lifestyles.

Nonetheless, while it is clear operators must deliver simplicity, convenience, richness, and “4 Anys” expectations, it is not clear which new features can be turned directly into sources of revenue or if they instead represent churn-protection or subscriber-acquisition tools first and foremost.

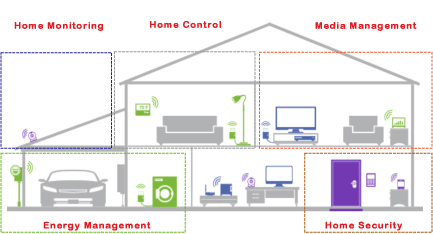

However, there is an emerging opportunity for services outside the core portfolio that does suggest the promise of new revenue. It also adds to the services bundle, creating more stickiness. This new opportunity is around home management, control and monitoring. Operators now can begin considering “Connected Home 2.0” – expanding beyond solely home-networked media experiences ( see Figure 1).

|

| FIGURE 1: Connected Home 2.0: Services Beyond Media Delivery and Consumption |

All Things Considered

By now, we’re all familiar with how broadband penetration has led to new applications and services:

Step 1: Broadband delivered to the masses.

Step 2: Home network coverage, laptops and neighborhood hotspots expand and multiply Internet access points.

Step 3: Smartphones and mobile services bring the Internet to every person.

We’ve now begun another phase of evolution:

Step 4: Embedded IP capability brings Internet access to everything.

This final step has vast implications. As stated by Parks Associates, “Everything will be connected on the network and should be accessible by any device.” If it has an IP address, it can access the Web and interact with other devices or servers in the cloud. Increasingly more household “things” are enabled, driven by low-cost volume silicon that is becoming more capable simultaneously. This includes game consoles and Internet-ready TVs, of course, but now it’s extending rapidly to security devices, IP cameras, appliances and energy devices. These objects are just waiting to have a meaningful IP conversation.

Home-management services, especially when they are cloud-based, provide that meaningful conversation. Connected Home 2.0 is a mesh of sensors, cameras and controllers, all communicating in a common language inside and outside the home. It is accessible through everyday devices, empowering consumers. Just as consumers can be virtually at work as telecommuters, they now can be virtually at home when away while being served from the cloud.

This step moves operators deeper into applications. Voice over IP (VoIP) strengthened the bundle considerably by delivering a core service. The bundle becomes further strengthened by home-management services destined to be similarly indispensable in a world of connected people and things. This is evidenced by market tracking, which shows consumers are increasingly interested in such services as part of a bundle, including an expectation to pay for them.

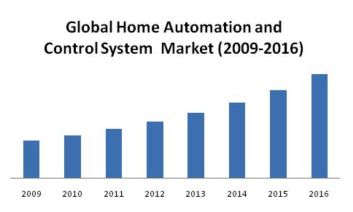

Of course, traditional home security already is a healthy, $10 billion-a-year U.S. business. Alternatives based on IP technology, self-monitored or as part of automation and control services, projects similarly. The expanded service portfolio registers interest in about one-third of surveyed consumers. Recent analysis (September 2011) projects the global market for home automation to show more than16-percent CAGR for the next five years ( Figure 2), projecting to about $35 billion in 2016. This translates into many more devices looking for that conversation that leverages their brainpower, which benefits both operator and consumer.

|

| FIGURE 2: Global Home Automation and Control Systems Market Forecast through 2016 (Source: MarketandMarkets, www.marketsandmarkets.com) |

Thinking About Standards

In addition to IP Web interconnectivity, wireless standards down the OSI stack have consolidated within the home to connect things. Of course, as the saying goes, the great thing about standards is that there are so many good ones from which to choose. In this case, standards focused specifically on control and automation are IEEE 802.15.4 (ZigBee) and Z-Wave. These competing options battle for market leadership by region and application.

The key requirements and characteristics of a protocol designed for home control and automation include robustness, high availability, low latency, low duty cycle, low power consumption (battery) and low bandwidth. The latter characteristic does not apply to such media as video monitoring.

Wi-Fi (and Bluetooth) now are in the picture as well. While bandwidth overkill, massive Wi-Fi volume enables low-cost integration. The excess bandwidth offers protection against potential smart-grid evolution. Expectations for grid optimization include many sensors and meters communicating often in real time, though at the whole-home level today. A low power-consumption option would strengthen Wi-Fi’s position.

Of course, IP-based wireline technologies also are suitable, but less practical for this application.

Above the IP layer, such mature auto-discovery protocols as Universal Plug-n-Play (UPnP), adopted by the Digital Living Network Alliance (DLNA), abstract the user from complex configuration. Such issues detract from today’s proprietary, single-purpose products, expanding the market to those turned off by these obstacles.

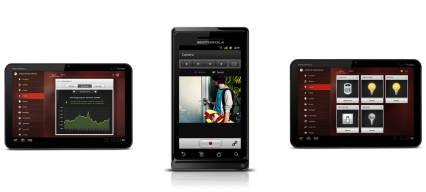

Simplicity is critical at every level. The home subsystems associated with these services required little human interaction traditionally. If they required attention, it often was because something was broken. It is, therefore, essential that home services not be a burden mentally. An easy-to-use, consistent user interface on all connected devices completes the simplification factor. Fortunately, consumers now are experienced users of technology like computers, tablets, smartphones and remote controls. These platforms enable rich UIs that can be customized and applied consistently.

|

| FIGURE 3: Simplicity and Convenience Are Critical Features |

New Use Cases

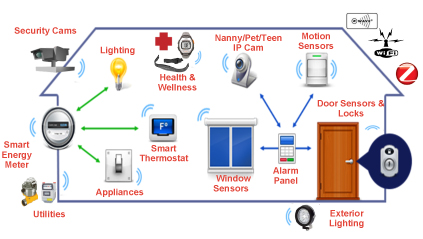

Traditionally, home subsystems had nothing in common except the source of powering; any switching and control generally was mechanical. As “old-timers,” we naturally are inclined to think: How many possible uses of this home management stuff do I really need? Figure 4 identifies some common examples as well as some compelling future applications. And it’s early in the evolution, with new use cases likely to emerge quickly.

|

| FIGURE 4: Immediate Opportunities and Emerging High-Growth Areas |

Home Security

Traditional home security can be enhanced and have other services built upon it with the ubiquity of broadband access and devices, and the emergence of robust cloud services. Examples include security cameras, a natural extension of conventional sensor-based alarm systems. Door, window and shade controls also are straightforward extensions simplified by personal devices, “broadband everywhere” and cloud services. The cloud also simplifies arming, in particular allowing it to be accomplished remotely.

Home Monitoring

Remotely accessible cameras offer nanny-cam, pet-cam, teen-at-home-alone-cam and elderly-relative-cam monitoring capability. They also provide a security blanket when adverse weather turns a relaxing vacation into one of stress over leaky roofs, falling limbs or basement water.

Home Control

Perhaps the most straightforward service to market, as evidenced by television commercials, is the ability to control lighting, climate, appliances, etc., remotely. Home control at a more sophisticated level includes the creation of “scenes.” Like programming a thermostat based on day and time, “scenes” set room lighting (natural or electrical), climate, sound – potentially even the position of the La-Z-Boy. This can be time-based, sensor-based or fingertip-based.

Health and Wellness

A high-potential growth area is health-and-wellness monitoring. Demographics and complex issues surrounding healthcare delivery are creating new pressures in that industry. Remote medicine and monitoring tools are evolving in response to these complex dynamics. Such technology reduces office visits through broadband connectivity and monitoring services accessible through the cloud by consumers and healthcare professionals.

Various custom devices are available today for monitoring chronic conditions and medications. Current market size estimates place this fragmented market in the same ballpark today as home security.

Energy Management

Energy management and smart-grid support also represent high-growth market segments, with billions in spending anticipated. Consumer awareness is on the rise as “green” initiatives take place everywhere.

There already is a market of smart meters that enable energy report services; consumers can monitor consumption at their convenience. Studies show that energy awareness leads to energy savings as consumers take an active role in managing use. Energy-management servers also can send out alerts identifying abnormal usage patterns or if a November bill nears a budgetary threshold.

Estimates for growth of home energy-management systems are enormous, growing from 1 million systems to 63 million by 2020, according to Pike Research – a nearly 60-percent CAGR. Surveyed consumers also expect Web-based dashboards and supporting device applications. Moreover, actual savings require action to be taken. When energy management is integrated with home control and automation services, the composite service makes it that much easier to manage energy use.

The Green Wave

From a policy perspective, consumer energy management is more likely to yield “green” benefits. Consumers have a direct financial stake in energy savings, unlike utility providers who mostly want to flatten peaks. Operators can point to savings as part of consumer ROI, and they can reap goodwill with customers and regional stakeholders on top of adding revenue.

Energy management actually already is aligned with cable operators’ own “green” efforts. The Society of Cable Telecommunications Engineers (SCTE) has an ongoing initiative called Smart Energy Management Initiative (SEMI) ( see related feature on page 20). It brings operators, vendors and experts in energy fields together, providing a forum for discussing methods, tools and experiences that lead to smarter use of energy across the industry.

“SCTE’s Smart Energy Management Initiative is leading the way for new thinking in hardware and facilities to optimize and harden operations, such as in our hybrid power system of solar panels, fuel cells and batteries that maintained headquarters power during Hurricane Irene,” says Derek DiGiacomo, senior director/Information Systems and Energy Management at SCTE. “Our new standards work surrounding power – Recommended Practice for Critical Facilities and Product Environmental Specifications – embodies this thinking. Ultimately, we see the industry benefiting from the development of new paradigms, such as the Adaptive Power System Interface Standard (APSIS), for hardware coming to market in 2013 and beyond.”

The SCTE describes APSIS as “power-consumption management by applying energy-reduction techniques (enabled or disabled) to align with traffic demand or other transactions as well as the predetermined need to regulate energy consumption in the event that the main energy source is reduced in capacity.” As such, it can be viewed as an early implementation of smart-grid concepts to cable.

Thus, “going green” has been proactively embraced in cable under SEMI. Consumers are similarly inclined, and operators can enable this interest while profiting tangibly and intangibly.

Smart As A Grid

There is vast investment occurring in the smart grid. The objective of a smart grid is to deliver robust power intelligently to users based on selected or learned use behaviors, the latter tied to real-time stimuli of fielded sensors. The term “demand response” describes how smart-grid power systems differ from traditional delivery.

The smart grid entails voltage and current sensors throughout the grid, it adopts more effective delivery architectures and it eventually turns to adaptive algorithms to optimize efficiency. This yields tremendous savings in use and costs, and it ideally becomes a component of a sustainable long-term energy plan.

Because the electrical grid is everywhere, multiple communication systems are necessary to connect sensors to a central processing engine/server. Estimates of sensor data for optimization suggest as much as 2 Mbps-5 Mbps per sensor on a grid [1] assuming the eventual inclusion of detailed information. This implies a role for broadband communications in partnership with utilities throughout the grid.

For Connected Home 2.0, smart-grid association begins with smart meters. These, too, have grown rapidly. IDC Energy estimates that 5 million units were sold in 1Q11, and a 25-percent CAGR is projected to 2015 (71 million). Fortunately, bandwidth expectations aggregating home devices, under today’s understanding, are modest – on the order of 10 Kbps to 100 Kbps – not much of a burden. Z-Wave is a 9,600 bps protocol and 232 devices maximum (ZigBee ranges from 20 Kbps to 250 Kbps). If 232 devices each consumed all 9,600 bps themselves (meshed today), we’d still only aggregate 2.2 Mbps.

However, with smart meters integrated on the smart grid, duty cycles for data capture to optimize the grid could increase. Bandwidth increases should be supportable because operators already must keep pace with compounding growth of current data services. However, two aspects of this traffic are worth watching, in addition to how the smart grid itself evolves at the residential level:

Low latency (100 msec maximum) is critical to real-time power-distribution optimization to avoid adoption based on “old” data. Like VoIP, it demands priority treatment.

While messages are low relative to bandwidth, their periodicity represents more contention with ensured low latency. This contrasts with human Web use characterized by burstiness, enabling high oversubscription. The net effect of more simultaneous use with low latency, leading to less oversubscription, is quantifiably more traffic in the aggregate.

Between traffic behaviors and unknowns about the ultimate content of the optimization payload, smart-grid evolution bears watching.

Connectivity of devices not associated with media or communications is now the budding phase of broadband expansion. Connected Home 2.0 already is underway – perhaps a modest condominium today, but destined to be a sizable celebrity retreat before all is said and done. The hardest part is done – building the broadband infrastructure and bringing about the maturity of Connected Home 1.0.

Dr. Robert Howald is a Fellow/Technical Staff and Jerry Kurtze is senior manager/Business Development and Marketing at Motorola Mobility. Contact them at rob.howald@motorola.com and jkurtze@motorola.com.

References

[1] Sood, V.k., D. Fischer, J.M. Eklund, T. Brown, “Developing a Communications Infrastructure for the Smart Grid,” IEEE Electrical and Power Engineering Conference, Oct. 22-23, 2009.