Competition Spurs Strong Increase in Cable Tech and Digital Media Salaries

By Pam Williams, CAE, executive director, CTHRA

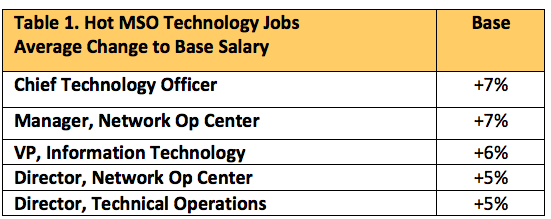

In today’s world, consumers have an ever-growing variety of options for viewing sports, news and entertainment programs thanks to the proliferation of online and mobile applications and the entrance of new content developers. Yet, while the number of competitors is on the rise, the talent needed to drive the latest technologies and digital content is extremely limited. As a result, the Cable and Telecommunications Human Resources Association’s (CTHRA’s) 2014 Compensation Surveys determined that the law of supply and demand is dominating compensation in our industry as salaries for technology (see Table 1) and digital media positions rose well above the national average in 2014. In addition, compensation soared for many sales positions and executives, particularly among MSOs, as they continued to receive very large incentive grants.

“Both the MSO and programmer community are competing with Apple, Google, Facebook and Amazon for critical talent in the technology and digital space,” said Karen Baker, vice president of compensation, NED, for Comcast Cable. “We need to adopt progressive pay practices for those employee populations — what may be good for some parts of the business will not work in Silicon Valley. We need to change and adapt to successfully compete.”

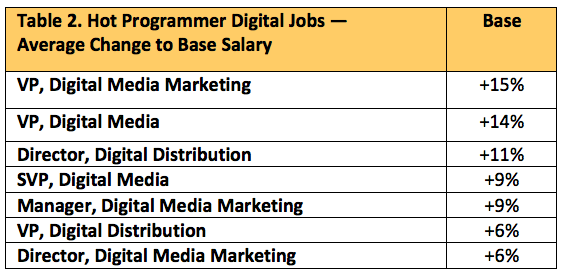

“Media companies are scrambling to simply keep up with the constantly evolving digital space, and all want the company with the next big digital breakthrough. As a result, premier digital talent is in high demand,” said Joanne O’Brien, senior vice president of HR for NBC News Group. Average base salaries for these jobs rose at rates from twice to five times the national average, with increases ranging from 6% for director of digital media marketing to 15% for vice president of digital media marketing (see Table 2).

Such targeted salary increases and incentives reflect the cable industry’s nimble response to the intense competitive landscape. Industry employers recognize the bottom-line impact of attracting and retaining key talent.

Sixty five industry employers participated in CTHRA’s 2014 Compensation Surveys [the participant list is included at the end of the article], and The Croner Company collected and analyzed the confidential data to identify benchmarks and trends. The surveys found that overall average salary adjustment budgets (which include pay raises delivered through merit increase, promotional increase and market or cost of living adjustment) remained on their steady upward track. Once again, cable operators reported an average salary adjustment budget of 3.0%, identical to last year, while programmer salary budgets grew by 3.1%, exceeding 2013 budgets. Nationwide, 2014 salary adjustment budgets averaged a 3.0% increase. (Source: ERC, Mercer, Hay Group, WorldatWork, Aon Hewitt, The Conference Board, Culpepper)

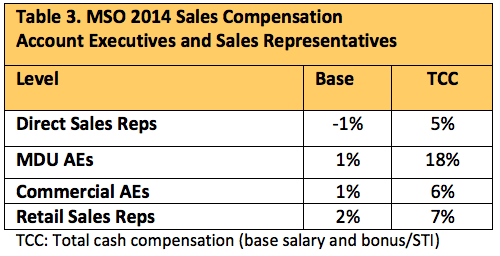

Both MSOs and programmers saw sales compensations sizzle in 2014. Total cash compensation (TTC), which includes salary and bonus, increased in all MSO sales categories. Especially hot this year were multiple dwelling unit (MDU) account executives, who saw TCC soar by 18% (see Table 3). Direct, commercial and retail sales representatives also experienced TCC increases of 5%, 6% and 7% respectively.

“The strong year-over-year growth in total cash compensation for sales employees is an important finding,” said Susanna Chan, senior director of compensation and talent planning for Charter Communications. “This growth is primarily driven by the increase in incentive compensation, so we will be doing more work and analysis in our sales commissions plans in particular.”

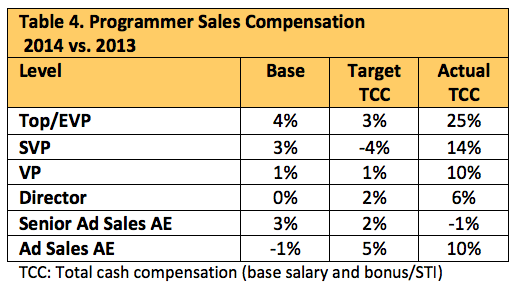

Programmers also experienced robust compensation growth for most ad sales positions in 2014. Although base salary growth and target total cash compensation was more modest, incentives surged in nearly all sales categories. EVPs topped the sales ranks with actual TCC rising by 25%. Other impressive gains came at the SVP and VP levels, with actual TCC escalating by 14% and 10% respectively (see Table 4).

“2014 was a really good sales year,” Hali Croner, chief executive officer of The Croner Company, said. “For nearly all sales positions surveyed, actual compensation exceeded target.” This aggressive growth may have been due to robust sales goals set in 2013.

MSOs and Programmers Increase Base Salaries

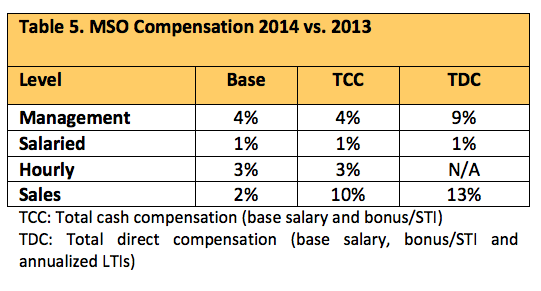

Among cable operators, base salaries for non-sales positions grew in all job categories, with increases ranging from 1% for salaried employees to 4% for management. Management and sales experienced robust gains in Total Direct Compensation (TDC), which includes base salary, bonus and long-term incentives (LTIs). TDC rose 9% for management and a hefty 13% for sales (see Table 5). For management, these gains were primarily due to large LTIs, while the increases for sales accrued from a combination of strong bonuses or short-term incentives (STIs) — driven by robust sales — and LTIs.

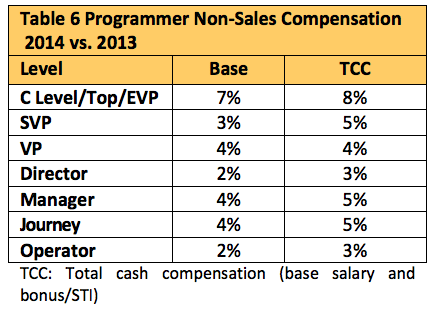

Base salaries for non-sales positions rose among programmers as well, with increases ranging from 2% to 7% (see Table 6) depending on position level. Incentives further boosted programmer compensation by another 1% to 2% for non-sales positions, with TCC increasing from 3% for operator-level jobs to 8% for executives in 2014.

Incentives Popular, Full-Value Shares Prevail

Incentives continue to be important components of compensation in the cable industry, reflecting employers’ emphasis on retention. Long-term incentives, such as stock options, shares and long-term cash awards, are also valuable tools for companies across the industry. LTIs are linked to a company’s financial performance and value creation over multiple years.

“We find the long-term incentive plan section of CTHRA’s Compensation Survey to be very valuable to understanding eligibility and granting practices,” said O’Brien.

Some 75% of MSO participants offer LTIs with most awards going to directors and above, although 16% also offer LTIs to managers. Especially noteworthy is that 75% of the MSOs offering LTIs provide full-value shares. Top MSO executives continue to receive large LTI grants exceeding $1 million indicating that these awards are primarily ongoing annual grants rather than new-hire or one-time retention grants. Among programmers, 76% offer LTIs to directors and above, and 83% of programmers that offer LTIs offer full-value shares.

“Participants are identifying their top people and locking them in with meaningful equity awards with vesting,” Croner said.

Among CTHRA’s MSO survey respondents, 88% offer short-term incentives or bonuses, with 57% of those offering STIs to all employees. STIs are also popular with programmers: 89% of respondents offer bonuses, with 39% of those offering STIs to all employees and 61% rewarding managers and above.

Understanding Pay and Promotion Paths

In addition to helping the cable industry maintain competitive pay, CTHRA’s Annual Compensation Surveys also keep programmers and MSOs in tune with changing job descriptions and career paths. Each year the surveys examine job families — adding new job categories and removing obsolete job titles.

The 2014 MSO survey reflected the industry’s growing centralization and regionalization. “This year we collapsed the management jobs into one set of management titles and asked participants to indicate whether those jobs had corporate or regional scope,” explained Croner.

The biggest change on the programmer front was the addition of two new career levels: senior manager and senior director. “The addition of these positions to many of the job families reflects the growing maturity of cable programmers and supports further career advancement,” Croner said.

The surveys are valuable tools in the industry’s fight to stay competitive. “We use the survey to influence our merit budget planning, analyze individual jobs and evaluate competitive pay positioning and pay ranges,” Comcast’s Baker said. “The CTHRA compensation survey is instrumental to our organization’s pay programs.”

CTHRA is currently enrolling eligible employers to participate in its 2015 Compensation Surveys. For more information, please contact Laurie Krashanoff of The Croner Company, at laurie@croner.biz or 415.485.5521.

—

2014 OPERATOR SURVEY PARTICIPANTS

Armstrong Utilities Inc.

Atlantic Broadband Inc.

Baja Broadband

BendBroadband

Bright House Networks

Cable One Inc.

Cablevision Systems Corporation

Charter Communications Inc.

Comcast Cable Communications Inc.

Cox Communications Inc.

DIRECTV Inc.

General Communication Inc.

RCN Telecom Services LLC

Time Warner Cable Inc.

Wave Broadband

WOW! Internet – Cable – Phone

2014 PROGRAMMER SURVEY PARTICIPANTS

A&E Television Networks LLC

Amazon.com Inc.

AMC Networks Inc.

AT&T

beIN Media Group LLC

Cablevision Systems Corporation

CBS Corporation

CBS Corporation – Showtime Networks Inc.

Crown Media Holdings Inc.

C-SPAN

DIRECTV Inc.

Discovery Communications Inc.

Disney ABC Television Group – National Broadcast Network

Disney ABC Television Group – Disney ABC Cable Networks Group

DLA Inc.

ESPN Inc.

Fox Networks Group – Fox Broadcasting Company

Fox Networks Group – Fox Cable Networks Group

HBO Latin America Production Services

Home Box Office Inc.

HSN Inc.

Hulu LLC

iHeartMedia

ION Media Networks Inc.

Jet Propulsion Laboratory

Madison Square Garden

Major League Baseball

Microsoft Corporation

MLB Network LLC

National Basketball Association

National Football League

NBCUniversal Media LLC – Cable Networks, Comcast Programming Group

NBCUniversal Media LLC – National Broadcast Networks

nuvoTV

PGA Tour

QVC Inc.

Scripps Networks Interactive Inc.

Sony Pictures Entertainment

Starz Entertainment LLC

The Inspiration Networks

The Tribune Company

The Weather Channel

Time Warner Cable Inc.

Turner Broadcasting System Inc.

Univision Communications Inc.

Viacom Media Networks

Warner Bros. Entertainment – The CW Television Network

Warner Bros. Entertainment

World Wrestling Entertainment Inc.