Does Broadcast Still Have a Chance in the Battle for Popular Scripted Series?

By Kayla Hegedus

Parrot Analytics Industry Data Scientist

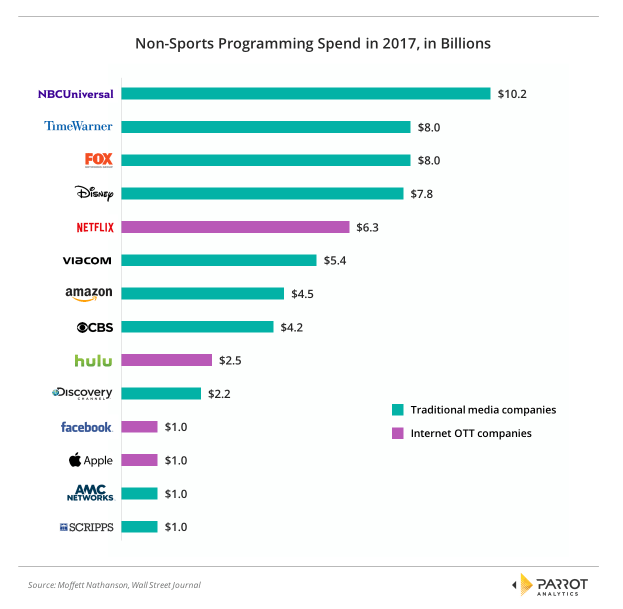

In this era of Peak TV, standing out from the crowd of content is more difficult than ever. The number of scripted series has grown 7% from last year to 487 titles, according to research by FX. In addition, the number of platforms that these shows appear on has also increased dramatically over the last few years. The most recent players in the SVOD market are tech juggernauts Facebook and Apple, both of which have a $1 billion budget for content in 2018. However, this spend will be dwarfed by Netflix’s estimated $8 billion content spend in 2018, which will be used in part to grow their original content catalog to over 700 titles. This budget makes Netflix’s spend comparable with the 2017 budget of Fox, Time Warner, or Disney. with SVOD platforms spending as much as traditional media companies, the proliferation of content will not be slowing down this year.

With the presence of such big brands and big budgets in the industry space, do traditional broadcasters still have a fighting chance of standing out? Broadcasters still have the advantage of reach: while Netflix has 55 million US subscribers and pay TV has about 94 million subscribers, broadcast can reach about 300 million people, over 90% of the population. However, this does not guarantee views, as shown by the fact that viewership of scripted series has been falling for years.

With increased consumer choices, broadcast networks have made changes in order to compete. To attract audiences who are now used to uninterrupted streaming on platforms like Netflix, Fox and NBC have plans to reduce the number of ads in primetime. Broadcast channels are also going to where the audiences are with online catch-up services on their websites; CBS has expanded this idea to a full SVOD platform, anchored by Star Trek: Discovery. These changes have expanded how they monetize their content, but for this content to succeed it must reach and appeal to an audience. Broadcast titles have the reach, but are they sufficiently popular to appeal to a large audience?

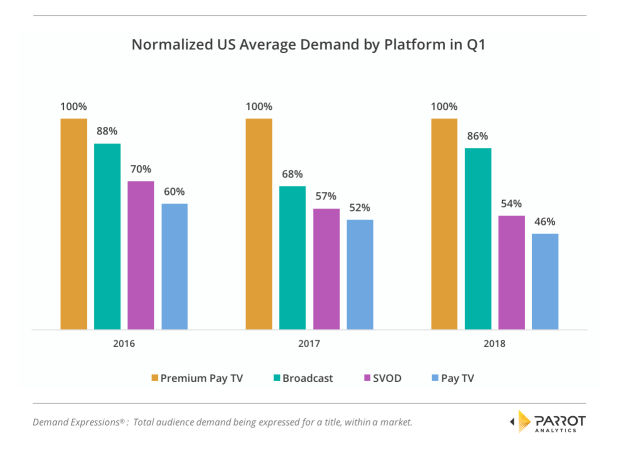

To find out, the demand for original content on broadcast, pay TV, premium pay TV, and SVOD platforms was averaged over quarter 1 in 2016, 2017, and 2018, normalized to the most popular segment:

Titles on premium pay TV channels are most popular on average: as these channels rely on subscriptions to operate, it makes sense that they need the most popular content to justify their price. SVOD platforms also need subscriptions but have a larger, broader catalog of content, driving views by appealing to a range of audiences. Pay TV channels take this idea to an extreme: content on each channel are designed to appeal specifically to its target audience, but as a result they lack the general popularity of broadcast titles.

While broadcast titles are not as popular as premium pay content, they are more in-demand than the average SVOD or pay TV title. As they are created to appeal to their large audience, this high demand means that they are succeeding in their goal of being broadly popular. Despite the buzz around SVOD platforms, the original titles on these platforms are still not as in-demand as an average title on a broadcast channel. The popularity of titles like This Is Us illustrates how broadcast titles can still spark wide national attention.

Though SVOD platforms seem to be getting all the attention lately, broadcast titles still have the popularity to stand out in the sea of content. While the content stays the same, the networks must now figure how to best monetize these titles in the new TV landscape.