TV Everywhere: So Much Potential Trouble, Not Enough Intent

TV Everywhere conjures images of titanic battles during which Comcast lays down its Xfinity brand in a FiOS household, U-verse sails into a Time Warner Cable home or Charter moves into Cablevision territory atop smart-TV app.

TV Everywhere conjures images of titanic battles during which Comcast lays down its Xfinity brand in a FiOS household, U-verse sails into a Time Warner Cable home or Charter moves into Cablevision territory atop smart-TV app.

It could happen. Once TV becomes an app, there’s no stopping where it can go. Whether that all-out battleground scenario will develop, however, depends on multichannel video programming distributors (MVPDs) across the cable and telco businesses (and, to a lesser extent, satellite) and whether these operators see the need to expand their territory or clutch more tightly to the subscribers they already own.

"When you understand the economics, it’s not as attractive a business proposition as it is a sexy storyline,” says Matt Strauss, senior vice president/Digital and Emerging Platforms at Comcast. It’s technically feasible but “the questions are less around technically if you can do it and more around from a competitive perspective if we can bring something to the customer that’s unique and compelling and provide the right level of quality over an unmanaged network,” adds Jeff Weber, president/Content and Advertising Sales at AT&T Home Solutions. “All of those kinds of questions are at the forefront rather than technically if we can get a video signals because it’s all IP.”

AT&T’s all-IP network provides an early advantage if the service provider wants to make U-verse video an app that rides on anyone’s broadband pipe. It’s exactly that kind of possibility that drives the “sexy” speculation about what would happen if TV Everywhere bedlam broke out because “AT&T and Verizon have IPTV systems but they also have national wireless footprints,” says Ray DeRenzo, CMO at MobiTV. “As soon as you see a player playing outside a franchise territory, it’s going to be open warfare.”

Subs Still Call The Shots

The end arbiter of such a move is the subscriber whom, MVPDs argue, would be hard-pressed to step away from the video portion of a triple-play offering and step into an “unmanaged” application from another provider — even a brand-name provider.

“It’s not an enhancement service we’re talking about here; this is a replacement,” says Weber. “Throw out your cable-TV or satellite service and replace it with something that’s over-the-top on an unmanaged network? That’s a bigger decision than adding a Hulu or a Netflix. That’s where the world is moving but, frankly, there’s work to make that right for the customer.”

The door’s surely open for MVPDs to start stepping all over each other, especially those with national footprints and wireless services, like Verizon and AT&T, that would serve as home bases for non-franchise-area offerings. “All of those things are very positive for us if and when the world moves there in any kind of mass market,” Weber agrees. But that right now has more sizzle than beef.

In the long term, cable operators, now in the process of moving QAM-based signals onto IP networks for multiscreen delivery, are not really hankering to do anything other than to enhance the triple play they offer existing customers. TV Everywhere also is supposed to be the MVPD answer to those pesky OTT services muddying the broadband pipes.

TV Everywhere, the argument goes, puts managed MVPD content in front of consumers anywhere and anytime, so why bother with Hulu, Netflix, Crackle or Amazon? Again, the big picture gets muddled when the details are revealed. Because TV Everywhere is, in a way, its own version of OTT, it probably plays with, and not against, the other offerings, adds Weber. “I actually think of them as one in the same. We go OTT all the time — U-verse.com, 170,000 assets OTT. We’re just delivering that, in most cases, to our U-verse TV customers.”

MVPD Vs. OTT

David Brouda, senior manager/Converged Experience at Motorola Mobility (now Google) has a slightly different viewpoint: MVPD content is better than OTT. “There are a lot of content deals locked up in cable that make them highly desirable for a majority of customers,” he notes. “People started using Netflix initially not because the content was better or different. It was because it was easier to use. If pay-TV operators adopt the philosophy of making things easier to use, they’ll see a higher customer satisfaction.”

Although they claim the decisions were based on other factors, several MVPDs took apparent steps to negate OTT with what only can be described as their own OTT platforms. Comcast launched Streampix, and Verizon signed a joint venture with Redbox-Coinstar. And, of course, Dish bought Blockbuster.

Throughout the MVPD space, though, OTT is seen as a niche offering for subscribers who want something conventional linear MVPD delivery can’t provide: long-tail content, lower prices, gender-specific programming, etc., and can thus be dismissed as a niche service with minimal impact.

The Larger Threat

A larger OTT threat looms. Apple, Google and, more recently, Intel are exploring the notion of aggregating content, building their own receiving devices and then delivering that content across MVPD broadband networks as “virtual MSOs.” The idea, like TV Everywhere, is intriguing and sexy, but the logistics are something less.

“It requires a huge war chest. It takes a lot of money to do,” comments John Gilles, executive vice president/Sales and Marketing for Coincident, a company that builds a second-screen platform that “puts people back in the living room on the big glass.”

Technically, it’s equally interesting and flawed. Google would run on Android that, right now at least, is not a standard TV platform in any cable, telco or satellite home but that could become more mainstream as Google uses its Motorola Mobility set-top-box (STB) business. Intel wants to build its own Intel-fueled STBs and then work with consumer-electronics vendors. And Apple is Apple.

“We tend to go where Apple makes the whole widget, the hardware and the software because we optimize the software for the hardware,” an Apple spokesman explained. “There is an integration between all the devices that makes it that much easier to recognize and implement now. As iPhones, iPads and Macs become more popular, Apple TV becomes a more compelling solution.” To Apple users. For content providers looking for a wide audience, that’s a limited group of viewers, no matter how devoted or upscale.

Anyway, right now “nobody’s doing that,” says Bruce Eisen, vice president/Online Content Development and Strategy at Dish. “I don’t think it’s going to happen in 2012 but, at some point in my lifetime, I do think that will happen.” And when it does, Eisen will be neither frightened nor impressed.

“Dish is not at a disadvantage because Dish is a nationwide company already. We compete with everyone. That’s in our DNA,” he explains. “The MSOs obviously are not nationwide and, if people start going over the top, that’s most likely going to be a nationwide offering, and the cable guys are going to have to start competing on that basis.”

What start? They already do, posits Comcast’s Strauss: “Satellite cuts across every market, and we compete with satellite and every other MVPD competes with satellite. So, in some respects, even if that were to happen, it’s really not uncharted territory for us; it’s what we’re almost used to in the competitive landscape.”

Customer Loyalty

So, taken on their word, MVPDs are not particularly interested in putting TV on every device just to compete with each other. They’re not particularly concerned about OTT — although some big content aggregators and virtual MSOs are on the radar. Strip away those sexy elements, and there’s only one reason to push vendors and content providers into an ever-widening TV Everywhere space.

Engendering customer loyalty for a multi-services package — and not finding new customers — is the reason for TV Everywhere.

“As an operator, our strategy is to say how within the Verizon suite of services we offer the best content choice, the best quality and the best choice,” says Maitreyi Krishnaswamy, director/FiOS TV Product Management at Verizon.

“We call it ‘authenticated TV.’ You have to be a Dish sub. You have to set up your credentials so you can log in with a user name and password,” Eisen adds. “For the specific content that you’re trying to watch, you have to be a subscriber to the underlying linear service.”

Location, Location

MVPDs have charged their vendors with finding ways to take video that traditionally flowed down a RF pipe into a STB and turn it into IP video available on any device a consumer can own and use. This process evolves in two concurrent locations: inside the home via Wi-Fi home networks and outside, where consumers fire up tablets, laptops and smartphones to connect to wireless broadband nets,

“The complexity of delivering programming outside the home, particularly live programming and the fragmentation of the different operating systems, and managing quality of service and bandwidth efficiency outside the home is a huge challenge,” says MobiTV’s DeRenzo. “Historically, no one ever cared about bandwidth efficiency other than wireless operators, because it was their networks that were being tapped.”

Inside the home, MVPDs must deal with an increasingly fragmented viewing base that no longer gathers as a group in front of the big screen. Rather, it drifts off to watch incremental content on a second screen or even to access more information about the big-screen content individually. It’s more of a mind shift and a technology shift for an industry that always has served residences and not people.

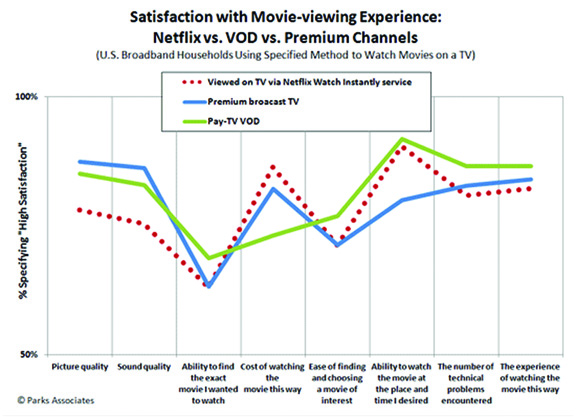

Lower Costs, Better Availability Behind Netflix Popularity |

| Recent research from Parks Associates says low cost and viewing flexibility give Netflix an advantage over pay-TV VOD and premium broadcast TV. “Consumers can pay for a month of Netflix for about the same amount as for two pay-TV VOD movies,” says Brett Sappington, director/Research at Parks Associates. “Parks Associates research shows consumers know the quality of the OTT service is not comparable to pay-TV quality, but the cost/benefit comparison is enough to affect their purchase decisions.” The Netflix over-the-top (OTT) service also influences the decision processes of pay-TV consumers, raising the possibility of Watch Instantly cannibalizing pay-TV offerings. The group found 16 percent of U.S. broadband consumers, when watching movies on VOD, consider instead using an online subscription service as an alternative. Similarly, 17 percent of those watching TV programs on a premium channel like HBO consider using Netflix instead.  "Netflix is competitive against VOD and premium channels because it has a decisive edge in cost,” adds John Barrett, director/Consumer Analytics at the company. “Its greatest weakness is picture quality, but there are times when the consumer will sacrifice quality for other considerations. Pay-TV providers should emphasize their inherent advantages in content and picture quality but also need to develop alternative services that counter Netflix’s advantages in cost and flexibility.” Pay-TV providers worldwide have adopted their own OTT services to combat such independent services as Netflix, but consumer awareness is low and few providers offer subscription OTT services. Comcast offers an OTT subscription service exclusively to its pay-TV subscribers, and Dish Network offers an online service to its subscribers via Blockbuster. Verizon and Redbox are partnering to offer an OTT service later this year. |

This new viewing trend, driven by Wi-Fi and delivered over home networks, would seem to finally spell doom for the beleaguered cable STB and glory for a new form of multimedia gateway that can feed IP signals to any number of devices, not excluding smart TVs, if it came to that.

Mike Pulli, president of Pace Americas, the world’s largest STB maker and part of the U.S. set-top triopoly, isn’t that concerned: “We doing both Wi-Fi send and receive in STBs. At the end of the day, (MVPDs are) going to try to put more intelligence into their modem or a set-top. At the end of the day, those two collapse into a single device, and I’m going to put lots of brains in there and turn my TV into a panel.”

The Evolution

That device could be a gateway — a sensible choice, until it comes time to tear out and replace existing set-tops and modems.

Chimes in Bob Scott, marketing director for Cisco’s service provider video business unit, “We still have a very robust set-top business (but), at the same time, we see the gateway as where the market is moving. It’s going to take time. You have to make some evolutions in your distribution network.”

One evolution that must happen is the bulking up of the CMTS to handle not only the traditional QAM signals but also the end-screen streaming that’s coming along. That’s being addressed, as are the other TV Everywhere specifics, in a space where technology problems are ebbing as other consumer-based challenges flow.

Every MVPD is at some stage of negotiating deals with content providers that, like the MVPDs themselves, must adjust to feeding individuals and not residences. As part of this transition, these programmers also must find new ways to track those viewers so they can be counted as “eyeballs” for advertisers.

Comcast has a summer trial going with measurement maven Nielsen on Xfinity video to determine who’s watching what on iPads and, at the other end of the MVPD spectrum, AT&T is using its all-IP strength to understand its viewers’ habits.

“We can take a holistic look, using measurement in a way that many of our competitors can’t. We can understand customers are deeply engaged with the content across TV, other devices and applications because that’s really the right measure of ultimate satisfaction,” says Weber.

For now, finding content, putting it on multiple devices and tracking those using multiple devices will keep MVPDs too busy to start competing with other. Longer term, though, another sexy story probably still is waiting to be written.

Jim Barthold is a freelance technology writer. Contact him at jimbarthold@comcast.net.