Think Outside The Cable Box: Align, Refine, Streamline

Because the TV no longer is the only channel — or even the primary channel — through which people consume entertainment content, cable operators are working to determine what the best models are for the long-term sustainability of their businesses. The playing field has changed.

Customers are individuals, not households. They are mobile, not tethered to the set-top box. They can interact with entertainment content providers across many different channels, including retail, affinity partnerships, online, mobile and public Wi-Fi. In this more complex, competitive environment, a defensive position isn’t enough.

Simply defending the existing customer base against cord-cutting and churn won’t solve the problem. Cable operators must be proactive about engaging consumers. One important way they can achieve this is to leverage the many channels they have available with an attractive and consistent customer experience.

Showing The Love

To gain consumer confidence and loyalty, cablecos must do several things:

>> Recognize consumers as valued individuals.

>> Cater to their preferences.

>> Resolve their problems efficiently.

>> Remember their past interactions with the company.

>> Anticipate offering they may want to try in the near future.

>> Do all of these things consistently across all channels.

|

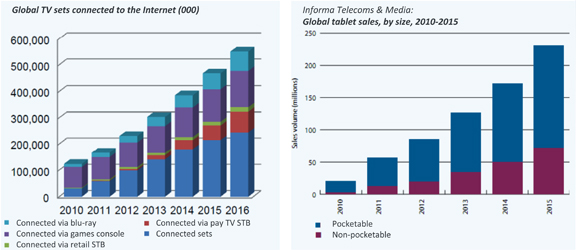

| FIGURE 1: Customer Habits Are Changing When It Comes To Video Viewing |

Whether it’s in the home, in the contact center, through a mobile or connected TV app, online, in a retail environment, or as a result of a more powerful and capable network, cable operators need to exceed expectations with the end-to-end customer experience they deliver. That experience must be intelligent, enticing and consistent. It must pervade every interaction that they may have with each individual. The battle to keep existing subscribers and to attract new ones from new markets depends on it. So where do you start?

Say Yes To Cable-Cutting

Cutting the cord isn’t just about losing pay-TV subscribers. It’s about the impact mobility and entertainment platforms, like connected TVs and Blu-ray players, are making because they open up new content-access options ( see Figure 1). Cable operators have to provide a consistent, attractive and competitive experience across all of these emerging platforms. The set-top experience – cable’s traditional channel – isn’t keeping up with these new interfaces, yet it remains the primary way cable customers are expected to access their content.

This rigidity, in terms of content access, needs to change. If customers are showing they are willing to cut the cable, then operators have an opportunity to cater to this desire. They have to create experiences and package compelling content in a manner that allows customers access no matter where they are – in the living room or elsewhere. Doing so requires thinking outside the cable box. It also requires multiple partnerships to deliver content across channels. Netflix, for example, is proving this as it partners with Microsoft’s Xbox Live Marketplace to enable customers to watch movies via Xbox as well as on tablets, mobile phones, PCs and connected Blu-ray players.

This partner-driven, cross-channel capability allows Netflix to eat away at cable operators’ pay-per-view revenues. Unlike many cablecos’ current TV Everywhere offerings, Netflix’s potential subscriber base is not limited by any geographic service area. Even those cable operators that offer on-demand content through channels like Xbox are only doing so today to defend against cable cutting – not as a means of generating new revenue.

Look Inward

As operators’ businesses have grown and evolved over time, they have increased the number of channels through which they interact with customers. Today, common channels include retail outlets, kiosks, contact centers, local offices, online portals, set-top interfaces – and mobile devices and connected TVs. As these channels have proliferated, a major emerging issue is that the quality of interaction is not consistent across them. The interfaces, or the staff operating them, don’t always have the same views, information, history, access to deals and promotions or visibility into the customer experience across the board.

A further issue is that many of these interfaces are out of date in the sense that they don’t meet customers’ increased expectations for rapid and user-friendly care. Contact centers can be inefficient; local offices have long lines and wait times; and set-top interfaces perform poorly and can require onerous processes for customers to access on-demand and pay-per-view services. Similarly, resellers and retailers often aren’t equipped to support and to cater to customers positively or effectively, and this diminishes the customer experience at critical points of engagement. All of these channels need to aligned, refined and streamlined.

Consider the benefits of improved channel alignment coupled with better customer awareness of the benefits they can access through any one of them. Often, customers can earn more loyalty points, rewards, discounts or free content as a result of making a purchase with specific retailers – if they identify themselves as a given cable operator’s customer. This lack of awareness is not specific to cable operators; online retail partners often suffer the same disconnect. But the breadth of channels and affinity partnerships puts them in a strong position to raise customer awareness and, as a result, drive customer activity, loyalty and engagement.

Despite the criticism of operators’ current channels, the cable broadband experience represents an area where cable’s customer experience typically is quite strong. If that reputation for quality and execution can be carried over into new domains, particularly as services go beyond the network footprint and the home environment, cable operators stand to benefit. A focus on network optimization as well as service quality (QoS) within and beyond the cable domain is critical to delivering broadband-like performance anywhere a customer goes.

Summarizing cable operators’ consumer-focused opportunities, the priorities are clear:

>> Improve the customer experience across all channels.

>> Create loyalty programs that leverage the breadth of valuable partnerships.

>> Package and present unique content and content experiences in user-friendly ways.

>> “Follow the customer” by creating delivery mechanisms and partnerships that enable customers to interact with content anywhere they go.

Win With Quality

Cable’s largest growth market lies beyond the consumer marketplace: enterprise services. Channel alignment and customer-experience quality will pay big dividends here.

There are many examples of cable providers succeeding in enterprise markets around the world. In many cases, cablecos are outcompeting traditional telecom providers because they can deliver equal- or superior-quality services and experiences. In Europe, cable operators have succeeded in meeting communications service providers (CSPs) head on in small and medium business markets by offering better QoS and performance guarantees. They have invested in the infrastructure necessary to compete against CSPs and, therefore, have been able to focus on quality of service and better service level agreements (SLAs) with packaged offerings.

Optimizing the utilization of network assets not only pays dividends in the ability to compete on service quality, it is also critical in three other ways:

>> From a financial perspective, as the network grows and becomes more complex;

>> As price competition increases; and

>> As the cost to win, keep and serve customers rises.

Responsiveness, picture quality and transactional success all are critical to having an experience customers perceive works well all the time. As cable operators move services like TV Everywhere and other mobile-centric offerings outside their network footprints, they tend to be concerned about how to assure QoS outside the DOCSIS environment. They are right to be concerned, but a focus on service-quality capabilities can overcome the technical and experiential risks.

Prepare For The Near Future

Ultimately, cable operators need to be realistic about where their markets are headed so they can prepare appropriately and remain in strong competitive positions:

>> They must prepare for a gigabit society, where bandwidth requirements will continue to grow, driven by content and the increasing processing power available to customers.>>

They must create unique customer experience through improved interfaces, superior usability and ubiquitous access to content.

Many cablecos own such assets as sports franchises and other units that produce content, own video rights and provide distribution. As such, they must package their unique content and capabilities effectively. Most importantly, they must package and deliver content so that it no longer is centered on the cable box.

Sanjay Mewada is vice president/Strategy at NetCracker Technology Corp. Contact him at sanjay@netcracker.com.