Rural Broadband: Is Fiber Cable's Best Buildout Bet?

“(Broadband) technology has changed traditional business models that all small business owners once relied on. As such, it is particularly important that small businesses have access to broadband technologies so they can compete on a global level … We don’t want to connect just Main Street, we also want to connect every street, every side alley and every country road so that all small businesses, whether they are in traditional farming interests or Internet start-ups out in these less populated areas have the same technological opportunities … at the same time, we must assure broadband is affordable.”

Sen. Mary Landrieu (D-La.), chair of the Senate Committee on Small Business and Entrepreneurship, made this statement in her opening remarks at an April 27 hearing on federal efforts to expand small-business Internet access across America, especially in small and rural markets that either are under-served or not served at all by broadband access to the information superhighway.

But while it is fair and legitimate for this issue to have entered the political sphere, politicians only can define a sound direction for public policy when they have a clear understanding of the business case for, and the capabilities of, the technologies at hand.

At that hearing, Steve Friedman, chair of the American Cable Association (ACA), declared, “Cable is the best technology in the ground today to meet the Administration’s goals of bringing 100 Mbps broadband speed to all. With the advent of DOCSIS 3.0, cable operators can deliver these speeds over their existing cable networks without the need for government funding.”

He also observed that the cable industry as a whole provides broadband access to 95 percent of the country, “the vast majority of which receive speeds of at least 3 Mbps – faster than most DSL providers.”

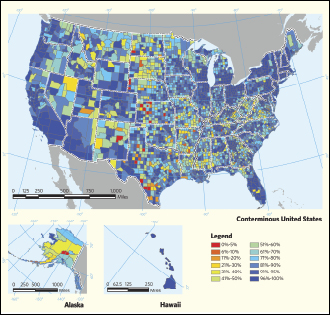

The National Broadband Plan, however, calls for at least 100 million U.S. homes to have, within the next decade, affordable access to actual download speeds of at least 100 Mbps and actual upload speeds of at least 50 Mbps (see Figure 1.) Obviously, there is a significant chasm to be crossed to reach that 100 Mbps target.

|

| FIGURE 1: The National Broadband Plan calls for at least 100 million U.S. homes to have, within the next decade, affordable access to actual download speeds of at least 100 Mbps and actual upload speeds of at least 50 Mbps. Today, much of the United States meets that challenge. |

The nation’s large MSOs are preoccupied by their battles to control large urban markets with high subscriber density, pitting advanced fiber-optic network technology against HFC networks operating on the DOCSIS 3.0 standard. Less lucrative suburban and rural markets often are neglected. Why?

For large operators, it is difficult to develop a viable business case for these markets. Even if stimulus funding is obtained (a foreign concept to many MSOs), a large operator still is faced with a fragmented marketplace, in which multiple applications must be made in multiple markets, which raises a legitimate concern about the ultimate return on the investment.

The blunt reality is that this is a capital-intensive business for any operator. Only now are we beginning to emerge from a credit crisis in which available capital was in short supply. However, given the high-volume metrics upon which the business models of the big guys rely, what may be a marginal play for them in terms of ROI may in fact present a good business opportunity for smaller operators – those that are more flexible and nimble in terms of the markets they accustomed to serving, can avail themselves of such funding sources as stimulus monies, and have fewer legacy issues related to big investments in traditional industry technologies.

Does this, then, position the small and mid-sized independent cable operators, represented by the ACA, as the hope of rural and small-town America for broadband connectivity? If so, they need to move fast. A recent study conducted by RVA Market Research for the Fiber-to-the-Home Council found that hundreds of small independent telcos, broadband service providers and municipalities, in addition to some cable-TV operators, already have brought gigabit-enabled, all-fiber service to a total of more than 1.4 million North American homes – about a quarter of all Fiber-to-the-Home (FTTH) and Business (FTTB) connections on the continent. All-fiber networks now reach 16 percent of homes in North America, with 5.8 million homes now receiving TV, high-speed Internet and/or phone service via these networks.

Typically, these municipal deployments have been done to provision advanced triple-play services. These networks provide affordable broadband services with upload and download speeds that start at 10 Mbps. This compares to services delivered over DSL and HFC, in which the upload speeds typically are only a fraction of the download speed – which can be a significant hindrance to local businesses attempting to expand and compete on the global stage.

And business is the real issue here. As both Sen. Landrieu and Sen. Olympia Snowe (R-Maine) emphasized during the April 27 hearing, the fact that only one percent of America’s small businesses export anything is a critical issue that must be addressed at a time when the nation is facing a jobless recovery.

Sen. Snowe cited a recent report from the Brookings Institute that found broadband capital expenditures helped create 500,000 jobs in 2009 alone while estimating a $5 billion increase in funding would increase broadband penetration by 7 percent, resulting in 2.4 million new American jobs.

If, in fact, the ACA’s membership has the technological capabilities in the ground today to meet the ambitious target set forth by the National Broadband Plan, as Friedman said, then significant work remains to be done. A key question however, is whether the technology available today upon which most of the industry is resting its hopes – DOCSIS 3.0 – truly has the horsepower to get the job done, and if it doesn’t, what options are there for cable operators that won’t break the bank?

The drive toward fiber at the community level was represented at the hearing by Terry Huval, director of Louisiana Utilities Services – a municipal-owned utility that operates one of the largest and most successful broadband fiber deployments in the country in the city of Lafayette. Residential service begins with a symmetrical 10 Mbps connection for $29.95 a month and 50 Mbps for $57.95. A business service with download speeds of as much as 100 Mbps also is available.

However, Lafayette faced bitter opposition from incumbent cable and telephone providers that fought the deployment all the way to the state Supreme Court after refusing to install an advanced broadband network on the grounds that the community was too small to warrant such an investment.

Typically, municipalities are forced to step in when commercial service providers don’t install advanced capabilities. But even Huval, for all his frustration, stated that deploying advanced broadband networks to small and rural communities shouldn’t have to be the job of local government.

“Our major point is that this kind of infrastructure is what we need to have, we need to all set the target – here’s where we want to be and ask everyone at the table, ‘who’s going to get us all there fastest,’” Huval said. “If the private sector can, then they should.”

Cable operators that sit back and wait run the risk of being left behind as other service providers take matters into their own hands.

Addressing The Challenges

In fairness to the membership of the ACA, Friedman did cite several key policy reforms government must undertake to help ensure cable operators serving smaller and rural markets can afford to make necessary broadband investments.

Friedman emphasized the importance of upgrading middle-mile infrastructure, an undertaking often too expensive for independent cable operators to do themselves. Rural middle-mile links, he claimed, “are often high-cost, low capacity pipes creating a bottleneck that reduces data speeds for our customers.”

He also cited the rising fees to attach cable wires and routing equipment to telephone poles owned or controlled by electric cooperatives and municipalities as barriers to rural broadband investment.

Lastly, Friedman called on the FCC to act on a recent proposal that would allow all cable operators to offer low-cost, low-functionality HD set-top boxes as a substitute for expensive CableCARD-enabled boxes mandated under regulations in effect since July 2007 for the transition from analog to digital service. He said this would help free bandwidth capacity that will allow for the provision of broadband speeds as fast as 100 Mbps.

However, while you can create more bandwidth if you repurpose some video channels to data (and one way to achieve this is to convert more channels to digital), you still aren’t going to reach that magical 100 Mbps target without that costly upgrade to DOCSIS 3.0.

Is DOCSIS 3.O Enough?

Which brings us to the fine point of the matter – how does DOCSIS 3.0 shape up against a passive optical network (PON) that brings fiber all the way to home and business? At what point does the cost and effort of upgrading to DOCSIS 3.0 and pre-planning a network to squeeze as much bandwidth as possible from an existing HFC infrastructure make fiber a much more economical alternative?

While DOCSIS 3.0 has made significant improvements in bandwidth availability compared with its predecessors through channel bonding, an operator always must make tradeoffs between downstream channel allocation and the type of traffic that will be carried on a network, be it video or data.

Such advanced network planning might meet the short-term traffic patterns of the network and the bandwidth allocation to the node (nodes represent a group of subscribers that are sharing the allocated channels and bandwidth, similar to a PON network where an optical fiber is serving multiple customers).

However, as consumers demand more and more bandwidth-intensive TV services like HD and 3D, having sufficient bandwidth to allocate will become increasingly difficult, if not impossible. DOCSIS 3.0 sharing might see as many as 150 subscribers on a node, with shared bandwidth approaching 160 Mbps, at a cost of 40 standard definition (SD) or 8 HD video programs. The data represents an average speed per subscriber of about 1 Mbps, which is a lot today, but as more subscribers download over-the-top video and other bandwidth-intensive material, more bandwidth is needed.

Fiber, on the other hand, provides more flexibility and requires less advance planning. Take for example, a network on one of the common FTTH standards: gigagit passive optical network (GPON), in which 32 subscribers are served from a single node. These 32 subscribers will share a 2.4 Gbps connection, for an average download speed of approximately 75 Mbps per subscriber. Obviously, we are much closer to the 100 Mbps target called for in the National Broadband Plan. Depending on how much bandwidth is being used by individual subscribers at any one time, service will almost always hit the 100 Mbps mark.

To achieve similar performance with DOCSIS 3.0, the number of subscribers per node would have to be limited to two. That’s going to require a lot of new investment in hardware and cable runs that, in the final analysis, makes a fiber deployment much more economical by comparison.

All this pertains only to the downstream capacity. A fundamental challenge, and limitation, with DOCSIS 3.0 is its upstream capacity, which is dictated by the actual plant, the issue of noise funneling depending on how many homes and businesses are on the same channel, and the condition of in-home wiring. This can be addressed to some degree by reducing the number of subscribers per channel but, again, that requires costly investments in new gear as well as frequent reengineering of the network.

A Happy Medium?

Radio Frequency over Glass (RFoG) also has emerged as new option for cable providers, in which RF transmission is used in both directions. However, it still is a DOCSIS-bound solution, subject to DOCSIS’ inherent shortcomings compared to fiber.

It bears noting that there are two parts to a cable operator’s network: the physical network infrastructure and the management system that manages traffic over that infrastructure. For many operators, being able to manage the network with their DOCSIS management system is of greater importance than the underlying infrastructure.

What cable operators need is a means to uncouple from that legacy HFC network and make the most of a DOCSIS investment by being able to plug into a fiber network they can manage with their DOCSIS system. That is coming.

In the meantime, we remain where we are – the big MSOs are, for the most part, investing little if any capital to upgrade their rural subscribers to DOCSIS 3.0. When the local municipality decides to fill the gap with a broadband network of its own, the response is often a price war, a legal action or even a departure by the MSO from the market.

There is no real reason why a MSO cannot move away from DOCSIS 3.0 for greenfields and new developments or deploy a FTTB overlay. An existing video headend, for example, can be shared between fiber and HFC cable, using existing voice equipment. While most of the MSO’s cable business (read “revenue”) can remain on its existing HFC build, it can deploy FTTH and FTTB to new greenfield developments or any other market segment to which it has not yet run cable.

And Smaller Players?

As for the smaller operators represented by the ACA, they are in an excellent position to address the rural broadband divide. The cable industry, after all, did begin as a grassroots endeavor to serve rural residents and small communities. Part of the solution resides with government dealing with the issues outlined by Friedman at the April 27 hearing.

Of course, favorable regulatory and policy decisions are only part of the equation. The onus is on the cable operators themselves to set their priorities for the future and to consider what technologies allow them to best serve the needs of the communities they connect. All stakeholders must work together to define business models that make it financially possible to roll out the advanced broadband connectivity rural and small communities need at an affordable price to subscribers. While Friedman said his membership can deliver broadband service without government stimulus monies, it may in fact be a necessary step to deploy a future-proof network that will endure for decades to come.

Because the thirst for more bandwidth shows no sign of abating.

Jim Farmer is chief network architect at Enablence Networks Inc. Contact him at Jim.farmer@enablence.com.