Redefining the "F" in HFC

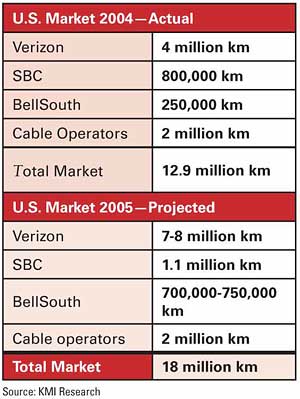

Is it time for the cable industry to fight fiber with fiber? Some industry watchers think so. With Verizon Communications, SBC Communications and BellSouth Corp. all investing heavily in long-haul fiber, the three biggest regional phone companies are installing broadband strings of glass throughout the country to replace their antiquated copper lines. Optical fiber experts figure that among them, Verizon, SBC and BellSouth are easily spending more than the entire cable industry to upgrade their vast networks to state-of-the-art condition. (See Table 1.) In fact, Verizon alone will spend about $13 billion upgrading its old phone plant this year, according to Joe Savage, senior vice president of the Fiber-To-The-Home (FTTH) Council. He said that sum is roughly equal to what all the major MSOs will spend together on their hybrid fiber/coax (HFC) network upgrades in 2005. The spending spree is part of Verizon’s ambitious plan to build a nationwide fiber-to-the-premises (FTTP) network that will reach at least 3 million homes and businesses by the end of this year and untold millions more after that in its 29-state territory. SBC is certainly no slouch, either. Under its Project Lightspeed venture, the company plans to spend at least $5 billion building FTTP and fiber-to-the-node (FTTN) networks throughout the Midwest, Southwest and West. Unlike Verizon, however, SBC will mainly focus on bringing fiber to the node, not all the way to the doorstep. Plans call for SBC’s new fiber network to reach 18 million homes by the end of 2007, 17 million of them by FTTN plus copper. "The phone companies have not been shy at all," says Jim Farmer, CTO of Wave7 Optics, in something of an understatement. "We live in a competitive world, and it’s not just the Death Star anymore. There’s terrestrial competition." A telco boom? Moreover, KMI Research projects that Verizon, the most aggressive of the Bells, will buy 7 million to 8 million kilometers of single-mode fiber this year after purchasing 4 million kilometers last year. KMI also forecasts that SBC, which bought 800,000 kilometers of fiber in 2004, will purchase another 1.1 million kilometers this year. Plus, BellSouth, which bought 250,000 kilometers last year, will quietly acquire another 700,000 to 750,000 kilometers this year, the research firm estimates. Richard Mack, director of research for KMI, says Verizon’s massive FTTP initiative alone drove "a doubling of fiber demand among LECs (local exchange carriers)" in 2004. As a result, KMI expects total U.S. purchases of fiber to surge from 12.9 million kilometers in 2004 to about 18 million kilometers this year, the highest figure since the telecom bubble of the late 1990s burst in 2000 and 2001. "The U.S. (market) hasn’t seen that in several years," Mack notes. "Broadband access is starting to drive fiber sales." In contrast, KMI predicts that the entire cable industry will buy no more than 2 million kilometers of fiber in 2005, less than 20 percent of the overall U.S. market and about equal to last year’s total. "They (cable operators) really haven’t gone up or down too much," Mack says. "Their use of fiber for new construction has been relatively flat." Thanks to this fiber frenzy, the three major Bells are threatening to snatch the technological edge away from cable operators, who have previously only had to worry about cutting-edge competition from satellite TV providers. BellSouth, Verizon and SBC are also threatening to encroach on cable’s core video business with a vengeance never seen before. "The telephone companies are very serious about video," Farmer says. Now that they’re losing voice lines, he notes, the phone companies know they have no choice but to plunge into the video business. "So video is no longer a science project" for them, he says. It’s not just the big phone companies that are investing heavily in fiber, either. In a report issued last spring, the FTTH Council found that the number of FTTH installations in the United States had surged 83 percent just since October 2004. The council reported that 398 communities in 43 states, most of them small towns, had already installed fiber networks. "There is an awful lot of interest in independent phone companies and small towns," Farmer says. "And there’s more to come. These people have been passed over by the cable companies and the phone companies." No worries … right? Despite this growing fiber gold rush, most top cable executives publicly proclaim that they’re not worried about losing their industry’s technological edge to the phone companies. They insist that the telcos are offering far more sizzle than steak with their costly, highly publicized FTTP and FTTN schemes. Take Tony Werner, senior vice president and CTO of Liberty Media. Speaking at the Society of Cable Telecommunications Engineers’ Cable-Tec Expo in San Antonio in June, Werner scoffed at the phone industry’s plans to seize the technological edge with their FTTP and FTTN builds. "Fiber offers no technological advantage to speak of," Werner said. "’Fiber’ is a sales term." Werner conceded, though, that the telcos’ construction plans could turn many consumers’ heads because of fiber’s unique marketing cachet. "Even my grandma knows fiber is good," he quipped, drawing laughs from the crowd. More seriously, Werner urged cable operators to craft "sexy" new names for their networks and products as a way to compete. "We need to come up with better marketing terms for our networks," he said. "FTTH impresses people; it just sounds good. We’ve got to have something that sounds as good or better." Cable technologists also contend that, through the massive upgrades they’ve carried out over the past decade, they have already installed enough fiber capacity in their own HFC networks to more than match the phone companies’ efforts. Indeed, most sizable cable operators have already extended fiber down to their nodes. So, much like Annie Oakley in "Annie Get Your Gun," they argue that anything the phone companies can do with fiber, they can do better. "Is it fiber or really the services that are delivered?" asks John Pascarelli, executive vice president of operations for Mediacom Communications. "They can’t come up with a service we can’t deliver." Pascarelli also believes that the debate over fiber deployment is overblown. "There’s no doubt people need more bandwidth," he says. "But the idea that it has to be fiber is being oversold. The reality is we’re doing a lot more with one fiber than we ever thought we’d do." Maybe a little worry … Cable engineers, strategists, marketers and other officials are clearly worried, though, about what the phone companies are up to. Privately, they express concern that the Bells really are serious this time about playing in cable’s sandbox. They also express concern that they still don’t have enough capacity to deliver all the snazzy new services they want to roll out. "The cable industry is very reluctant to talk about anything that might indicate they need more bandwidth," says one vendor who asked not to be named because of the subject’s sensitivity. "But they do need more bandwidth. It’s not a crisis yet. But look at the trends, with HDTV (high-definition TV), VOD (video-on-demand) and increased data speeds all taking up more bandwidth." As a result, cable executives are publicly investigating ways to boost their bandwidth capacity, including channel-bonding high-speed data lines, digitizing their entire networks and deploying switched digital broadcast technology. But, less publicly, they’re also exploring ways to add precious fiber to their networks without blowing their capital budgets. Citing competitive reasons, cable operators generally won’t discuss their plans to add fiber to their systems. "We’re adding fiber as needed," says a Charter Communications spokesman in a typical comment. "But there’s generally no need." Vendor perspective Yet industry equipment vendors say they see all the major MSOs studying how and where they can install more fiber lines to boost their bandwidth. And they expect to see more such efforts as Verizon, SBC and BellSouth expand their fiber efforts. "I think it’s safe to say they’re (cable operators are) looking at it very, very seriously," Farmer says. "There is definitely activity out there." For one thing, most major cable operators are quietly dividing their nodes in half or more and running short fiber lines to connect them. So cable nodes that once encompassed 1,000 or more homes passed are shrinking in size to 500, 400, 300 or even fewer households. Vendors cite such MSOs as Comcast, Time Warner Cable, Cox Communications, Charter, Bright House Networks and Cablevision Systems as leaders in this node-splitting trend. "We now see MSOs driving from 500 homes per node down to 150 homes," says John Hewitt, vice president of cable sales for Alpha Technologies. "It’s a sign of much more fiber going in and fiber going closer to the home. They’re approaching fiber to the curb." Farmer concurs. "Fiber goes down to the node" already, he notes. "But we’re now seeing people talk about (nodes of) 100 homes or less." In addition, cable operators are installing more fiber lines to cater to the increasingly promising commercial market. With many, if not most, small and medium-sized firms located beyond the reach of the typical residentially oriented cable plant, cable operators are increasingly relying on short fiber extensions to serve the companies in their franchise areas. "It’s not long-haul fiber, but it’s a lot of extensions," Hewitt says. "It’s not the heyday of 2000, but it’s still very strong." Greenfield projects Seeking to compete with the phone companies for other fresh prospects, cable operators are also looking at building all-fiber lines to new housing developments in largely suburban and exurban areas. Such regional Bell operating companies (RBOCs) as BellSouth have been pursuing exclusive deals with these "greenfield" developments for years, enticing developers by offering to install spanking new fiber networks to deliver advanced broadband services. Thanks to this aggressive approach, BellSouth now has FTTP lines passing more than 1 million new homes in its nine-state region of the Southeast. "Developers are asking for it," Hewitt says. "It costs more to install, but less to maintain." Wait and see Will these steps be enough to stave off the Bells’ fiber invasion? For the experts, the verdict is still out. The big question is how much more capacity both industries will need to offer such services as HDTV, digital video recorders (DVRs), VOD, voice over Internet protocol (VoIP) and whole-home networking, among others, over the next few years. Nobody knows that answer just yet. "I don’t know if they’ll (cable operators will) ever need fiber-to-the-home or fiber to the last 10 homes," Hewitt says. "Maybe for the next five years, MSOs will keep the RBOCs at bay by getting down to 150-home or 100-home nodes." Alan Breznick is a contributor to Communications Technology. Reach him at albreznick@earthlink.net.