New Opportunities On Tap: Crafting Cable’s Multi-Service Brew

Cable operators have evolved architectures and have adapted services for decades as new technology begat new opportunities, time and again. It’s a cycle that began in earnest with the introduction of digital TV in the 1990s, and it recently has accelerated.

Cable operators have evolved architectures and have adapted services for decades as new technology begat new opportunities, time and again. It’s a cycle that began in earnest with the introduction of digital TV in the 1990s, and it recently has accelerated.

For both residential and business services, new platforms are being deployed to satisfy market requirements. This evolution adds a new degree of heterogeneity to cable networks – a dynamic potentially opposed to the promise of network and operational simplification. The networking technologies being introduced are not new – in fact, they are quite mature. However, they matured mostly outside of one another and of the cable architecture.

Shifting Sands Of Video

Residential services today are almost unrecognizable compared with those that were available as recently as the early 1990s. It is a remarkable testament to the flexibility of the hybrid fiber coax (HFC) architecture and the adaptability of operators to meet customer demands.

Additional change now is afoot, tied to the all-IP migration. It will enable delivery of compelling new converged services, for sure. However, from a network-technology perspective, the key point is that DOCSIS takes on a larger role, adding managed video delivery.

While a different video architecture, IP video still is simply a shift from one legacy platform to another, a move cable anticipated with the Converged Cable Access Platform (CCAP) initiative. While ground-breaking, CCAP maintains protocol homogeneity in the residential network, just on a larger scale.

Taking Care Of Business

Residential network homogeneity contrasts with cable’s business-services growth. Beyond DOCSIS-based opportunities for small-to-medium businesses (SMBs), this market now includes large enterprise services – guaranteed rates, service types, and reliability requirements. These solutions typically are fiber-based – historically point-to-point, active Ethernet.

More recently, operators are adopting Ethernet Passive Optical Network (EPON) technology. Both options are present and likely to grow. EPON may grow more rapidly by percentage, not only because it represents less of the existing market, but also because support for EPON is identified in CCAP requirements. Going forward, EPON is an important complementary piece of cable’s multi-technology network.

Nonetheless, there is substantial active Ethernet deployed. Demand is growing due to the same bandwidth dynamics of the residential plant – more Mbps demand per year. New throughput demands and bandwidth pressure on the residential DOCSIS network drives interest in fiber solutions.

Marriage In The Air

Finally, after several attempts in the past decade to create a healthy marriage with Wi-Fi, cable is finding a business case for access points (APs) in the plant. Wi-Fi is a natural fit to the consumer expectations of ubiquitous access. The truly “anywhere” component of “4 Anys” services simply requires a wireless component. It is impossible be tethered everywhere a subscriber wants services.

Fortunately, during the last cable/Wi-Fi decade, the technology evolved to higher speeds and wider coverage, making hotspots much more capable. Additionally, technology that integrates Wi-Fi and DOCSIS matured. It also has developed to include 3G/4G radios – a powerful addition, but also a more complex set of integration issues.

CCAP Looks Ahead

As mentioned previously, CCAP has been identified as a critical, emerging component at the edge of the network. CCAP takes advantage of increasing silicon densities to deliver more RF channels per port and more ports per rack unit (RU), offering massive physical savings and simplification in congested hub locations. As described, its core residential services are under the umbrella of legacy networking technologies.

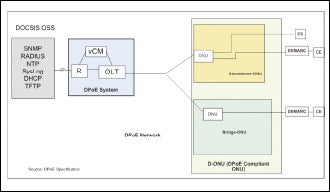

However, by including support for EPON, CCAP consolidates an important new network capability into this single platform. A critical element of this is the development of DOCSIS Provisioning over EPON (DPoE) specifications. These specs describe support of Metro Ethernet Forum (MEF) services over EPON access, and they specify provisioning of these services using the DOCSIS back-office.

By making the EPON Optical Line Terminal (OLT) look like a CMTS, and the Optical Network Unit (ONU) look like a cable modem, it allows operators to leverage DOCSIS servers for EPON business subscribers. Implemented using software-based middleware, DPoE is key to simplifying EPON for cable – it’s about as smooth as it gets!

DPoE v1.0 (February 2011) defined requirements for MEF Ethernet Private Line (EPL) service. DPoE v2.0 will extend this to other MEF services. A DPoE reference network is shown in Figure 1 [11].

Outside Plant

Introducing technology to cable hubs is friendly, logistically – unload a truck, roll out a pallet, and let engineers descend to give birth to a new platform. The outdoor plant is…unfriendly.

Fortunately, multi-wavelength optics and segmentable architectures have evolved to more elegantly support increasing narrowcast bandwidth as well as new service types aligned with new growth. Modern nodes – the heart of the outdoor plant – are customizable, do-everything platforms configurable to the service needs of the operator. Motorola’s SG4000 node, shown in Figure 1a, is an example of this modern architecture.

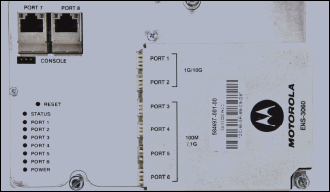

In Figure 1, pluggable slots allow operators to tailor nodes to service needs, including integrating the kind of new networking capabilities described above. An example of this is configuring the node to serve business Ethernet customers with a module plug-in, such as that shown in Figure 2. Gigabit Ethernet links can serve multiple businesses in an area from this module.

|

| FIGURE 1: DPoE Unifies Service Delivery for Different Domains in the Cable Network |

|

| FIGURE 1a: Modern Nodes Offer Unprecedented Service Flexibility |

|

| FIGURE 2: Business Ethernet Can Be Supported In Modular HFC Nodes |

Operationally, active Ethernet services represent a parallel network. Typically, off-the-shelf network management systems (NMS) are used, such as HP OpenView or vendor-provided tools (Web GUI, CLI or scripting) for provisioning and management. Because of the rigid certifications built around MEF criteria, business services operations silos often exist, consistent with major differences in residential and MEF servicing.

MEF now is defining a common information model (MEF 7.2) to support Carrier Ethernet management based on several ITU standards, offering standardization of configuration, fault and performance management.

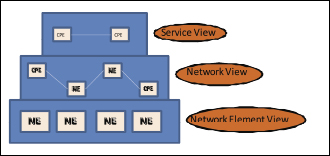

A layered architecture, an approach described within ITU, MEF and the Tele-Management Forum (TMF), is illustrated in Figure 3. This approach establishes an end-to-end service view of network management, necessary to overcome challenges of heterogeneous networks.

|

| FIGURE 3: A Service-Centric View Provides Seamless Functionality |

Thus, tools exist and standards are moving in the right direction for increased convergence. However, note that DPoE defines MEF service types. As a key component of future cable fiber architectures, it is reasonable to consider adding active Ethernet service management under the DPoE umbrella. It remains to be seen which directions operators take for business Ethernet services expansion.

Outside The Wires

Wireless has added another new (old!) technology into the cable plant. A couple of key factors have aligned that make the marriage work this time around.

First, the technology has advanced significantly, with MIMO and in multi-carrier modulation, coding and signal processing. The result is high data rates supportive of aggregate use with high QoE.

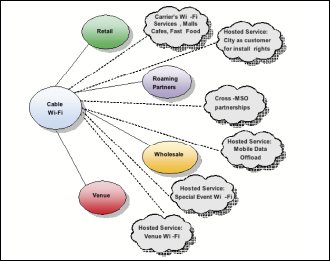

The second factor goes back to the “4 Anys” expectation – ubiquitous access can’t occur without wireless. Figure 4 illustrates the potential “Anywhere” opportunities unleashed by cable wireless.

|

| FIGURE 4: Services “Anywhere” Is Impossible Without Wireless |

|

| FIGURE 5: Cable Wi-Fi: Moving From Free To Fee |

|

| FIGURE 6: A Cable and Picocell Architecture |

Initially, operators deployed Wi-Fi to reduce churn with free a add-on to data plans. The next phase may include revenue opportunities that capitalize on the explosion of tablets, cloud services and mobile computing. Figure 5 [2] illustrates current and future business models and opportunities associated with hotspot distributions such as those identified in Figure 4.

Like Ethernet, such diverse platforms as Wi-Fi introduce networking challenges. Here, it is the blending of wireline and wireless domains in access and core. Key areas include:

>> Higher speeds and QoE in challenging environments,

>> Seamless access and mobility,

>> Simple integration into back-office and

>> Cross-network integration for business-model execution

High Speed Connectivity – The latest standards promise gigabit rates (IEEE 802.11ac-ad). Recent amendments facilitate technologies for higher, uninterrupted throughput. Advanced services imply QoS and traffic management, relatively new for Wi-Fi.

Seamless Access – Seamless access is critical, yet increasingly complicated across such heterogeneous domains as Wi-Fi and 3G/4G. Cable Wi-Fi solutions provide a seamless user experience today and, for the operator, data security, control and policy-management capability. Secure tunneling protocols and seamless authentication (IEEE 802.11u or SIM-based EAP-SIM/AKA [7]) are main features of the next-generation hotspot (Hotspot 2.0 of Wi-Fi Alliance). 3GPP and the Wireless Broadband Alliance are working to integrate 3G/4G and Wi-Fi networks [1].

Simple Operator Integration – Currently, Wi-Fi network-management systems are separate tools. However, some products [5] support open MIBs and standard interfaces that integrate efficiently with popular third-party NMS systems. However, a full integration of network management and monitoring across domains is not yet available. Mobile operators are necessarily further evolved in access and charging models, while this is still evolving for Wi-Fi. Although not needed for free data service extensions, advanced services will require more cellular-like policy management and services accounting.

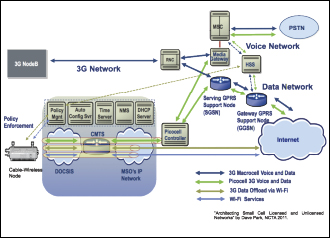

Cross Network Integration – Unified systems of Wi-Fi APs with picocells add integration complexity, but also new revenue potential as 4G bands become congested. Integration today is mostly separate platforms, as in Figure 6 [5].

New network-discovery standards and selection (between 3G/4G and Wi-Fi) [10], seamless authentication methods and application of policies from mobile core to the Wi-Fi session [6] enable operators to effectively provide mobile offload.

Like Wi-Fi, cable and cellular have also had an on-again, off-again relationship. Owning cellular deployments no longer is attractive to many cable operators. Aside from fiber backhaul services, 3G/4G integration is more “off” than “on” today but, with 4G itself early in its lifecycle, the book is not closed. The continuous work of bridging network domains only will benefit cable in the future as it considers business opportunities on the RF side of the cellular infrastructure.

Too Much QoS?

Lastly, when network and integration obstacles are satisfied, there is the basic matter of treating the actual payload traffic properly so the applications themselves provide consumer delight. QoS often is leveraged within uniform networks to differentiate such traffic as video, voice and data. Network heterogeneity makes this a challenge due to inconsistent tools and lack of communication across domains.

Typical QoS mechanisms include Classification, Priority Queuing, Bandwidth Reservation and Traffic Conditioning. Though common techniques, they tend to be applied non-uniformly. This non-uniformity is readily seen within the aforementioned Layer 2 technologies important to cable:

Ethernet – Classifies traffic using 802.1p priority bits;

DOCSIS – Uses the concept of service flows to classify packets, which are shaped, policed and prioritized according to QoS parameter definitions;

Wi-Fi – Wi-Fi Multimedia (WMM) defines four access categories (voice, video, best effort, background) to prioritize. Mapping of a User Priority to Access Category is recommended by 802.11e. 802.11u aims to standardize further, as implementations vary.

PON – In EPON, Multiple Link Layer Identifiers (LLID) can be used to classify traffic and service according to negotiated QoS definitions. GPON uses the concept of traffic containers.

Layer 3 QoS consists either of a differentiated services model (DiffServ IETF RFC 2474/2475) or a reservation model (IntServ IETF RFC 1633).

The domain-centric legacy places the burden of managing disparate policies on the operator, making implementations error-prone and inconsistent, and services relying on QoS less robust. Much work is going on to reconcile cross-domain QoS but much is left to be done. Some key ideas are identified below.

Keys To Extensible QoS

Several consortiums are defining End-to-End QoS architectures [3]. These benefit new networks, but represent exhaustive rework and disruption to existing networks. An approach based on existing mechanisms in each domain is preferred. Key concepts are described below [4]:

Category Mapping – Common requirements must be the guiding principle across domains. IETF and 3GPP both define four service classes with similar requirements. Table 1 illustrates these and potential Layer 2/Layer 3 categories for different network architectures.

Mapping Layers – There is no defined QoS mapping between Layer 2 and Layer 3. A consistent vertical mapping across network elements will avoid inconsistencies.

Queuing – Today’s options generally do not provide fairness. This can be improved if the type, rates and weighting were dynamic and based on traffic over a period of time.

Bandwidth Reservation – DiffServ is widely supported, with guarantees for aggregate flows. But minimum bandwidth typically is pre-allocated by forwarding class. Dynamic allocation, with nodes exchanging traffic class information, overcomes limitations of pre-allocated bandwidth.

Cross-Domain Communication – While end-to-end signaling may be impractical, a communication path between the nodes residing at the edge of each domain improves cross-domain QoS assurances.

The key to achieving QoS interoperability across network domains is to recognize and reconcile the different QoS implementations between them. This is, of course, easier said than done, and mostly for non-technology reasons. However, heterogeneity will place a premium on putting these concepts into practice going forward, rewarding operators that keep their customers happy, wherever they go.

Wrapping Up

The introduction of new services has clear operator benefits – finding new customers, keeping old customers and deriving new avenues of revenue. In some cases, they also simplify operations within CCAP and through DPoE.

Other service-growth areas, such as wireless and active business Ethernet architectures, also deliver compelling new service value. Solutions have been developed for the HFC architecture to meet the demands of this service growth. Effort remains for a complete operations convergence of all network aspects within the expanding multi-technology brew, but increasing convergence is expected over time based around industry and standards-body initiatives. Heterogeneity also has implications for QoS support, and work is going on in this area as well, so that customer traffic gets the treatment it deserves.

| Traffic Category | Ethernet Wi-Fi DOCSIS, PON | Diffserv Layer 3 |

| Real Time Traffic (Voice) | P bit 6, 7 AC3 UGS, TCONT 1 | EF |

| Interactive (Video) | P bit 5 AC2 RTPS, TCONT2 | AF |

| High Availability (Data) | P bit 3, 4 AC1 nRTPS, TCONT3 | AF |

| Best Effotr (Data) | P bit 0, 1, 2 AC0 BE, TCONT4 | Best Effort |

Table 1: Traffic Category/QoS Mapping

An all-IP transition built on open standards across network layers offers the best opportunity to fully realize convergence. In driving towards this, however, more new network “things” are likely to emerge just as older ones become integrated. If there is one certainty, it is that cable will adapt the architecture and the service mix as necessary, first and foremost to meet customer demands.

Dr. Robert L. Howald is Fellow of the Technical Staff, and Dr. Sebnem Zorlu-Ozer and Srividya Iyer are Principal Staff Systems Engineers at Motorola Mobility. Contact them at rob.howald@motorola.com, sebnem.ozer@motorola.com and srividya@motorola.com, respectively.

Footnotes

[1] Choi, Sungho “ Evolution of the 3GPP Network Architecture,” 3GPP workshop, 30 May 2011.

[2] Frederick, Steven, Sebnem Zorlu-Ozer, and Dave Park, “ Wi-Fi Hotspots for MSOs, an Operators Guide to Best Practices, ” SCTE Cable-Tec Expo 2011.

[3] Iancu, B, a/V. Dadarlat, A. Peculea, " End-to-End QoS Frameworks for Heterogeneous Networks – A Survey."

[4] Iyer, Srividya, Dr. Nagesh Nandiraju and Dr. Sebnem Zorlu-Ozer, " An Extensible QoS Architecture for a Heterogeneous Network Infrastructure to Support Business Services," 2010 Cable Show Spring Technical Forum, Los Angeles, CA, May 11-13, 2010.

[5] Park, Dave, “ Architecting Small Cell Licensed and Unlicensed Networks.” Cable Show Spring Technical Forum, Chicago, IL, June 14-16, 2011,

[6] “ Building a carrier-class Wi-Fi network with 3G offloading. ” webinar.telecoms.com, February 2012

[7] “ Extensible Authentication Protocol Method for Global System for Mobile Communications (GSM) Subscriber Identity Modules (EAP-SIM). ” IETF RFC 4186, January 2006.

[8] ITU G.1000 Standard, Communications quality of service: A framework and definitions, 2001.

[9] “ Mobility and Roaming.” whitepaper 2012, www.belairnetworks.com/service-providers/cablemso/mobility-and-roaming

[10] “ Wi-Fi Certified Passpoint: A new program from the Wi-Fi Alliance to enable seamless Wi-Fi access in hotspots. ” Wi-Fi Alliance, February 2012.

[11] DPoE Architecture Specification, DPoE-SP-ARCHv1.0-I01-110225