Like Digits Through the Hourglass

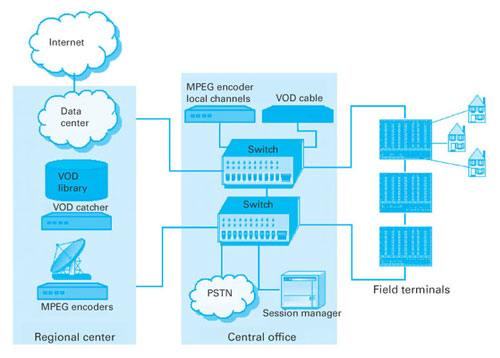

Competitive and economic pressures are forcing cable operators to deploy new services aggressively. But these new services stress the network�s capacity. Migration to an all-digital product offering is a paradigm shift necessary to support the increased capacity requirements of advanced services. But without a sound strategy, the migration likely will yield minimal competitive advantages and operational savings. There are several advantages for cable operators to consider as they contemplate the migration to an all-digital product offering: Less tangible drivers (not covered in detail in this article, but deserving mention) include: The importance of each individual driver will vary per system and operator depending on the level of competition, available system bandwidth and new product deployment schedule. Competitive response Calculations performed on a modern hybrid fiber/coax (HFC) cable architecture designed for a 49 dB carrier-to-noise ratio (C/N) at the end-of-line validates satellite�s assertion that its digitally delivered programs provide better quality than analog channels delivered over an HFC plant. The video signal-to-noise ratio (S/N) of a program delivered via an analog channel through a set-top box is 47 dB. The video S/N of the program delivered in a digital format mirrors the source content at 54 dB. One can argue that this performance difference is not significant when viewing an NTSC television with an RF input and 483 scan lines of resolution. The difference, however, can become quite visible when scaled to fit a high-definition television (HDTV) with a component video input and 1,050 scan lines. As more HDTVs enter the market, the disparity in performance between digital and analog signals will become more apparent. There also is a significant difference in the audio performance delivered using Dolby Digital encoding versus broadcast television standards committee (BTSC) modulation. The 100 percent channel separation of six distinct audio channels and 90 dB of dynamic range delivered with Dolby Digital encoding is superior to the 30 dB of separation between the two-channel matrix containing four channels of Pro Logic surround sound found in BTSC. Fiber-to-the-premise On the telco front, several regional Bell operating companies (RBOCs) have collaborated on a fiber-to-the-premise (FTTP) request for proposal. Verizon and Bell South plan to deploy this architecture to major new build and complete rebuilds this year. Many of the FTTP and very high-speed digital subscriber line (VDSL) architectures being contemplated by telcos and overbuilders also will have the capacity to deliver every channel with digital quality. If the major RBOCs truly commit all large new-build projects and 100 percent rebuild projects to this architecture, the prices for this equipment will decrease, thus spurring deployments. (figure 1) While the initial results of the major telephone companies� FTTP request for proposal focused on an ATM PON solution for voice and data with a more traditional 1,550 wavelength overlay for broadcast video, some other architectures being considered could have substantial operational advantages by leveraging a switched digital video infrastructure converging all services onto a single delivery system. Using this solution, telcos would not need to understand the complexities of RF and baseband video signals, but simply would switch streams to the requesting destination from the central office. (See Figure 1 above.) Content is received, encoded and aggregated onto a fiber distribution system at a regional or national level. It then is delivered to the various central offices as a Moving Picture Experts Group (MPEG) stream over an Internet protocol (IP) or asynchronous transfer mode (ATM) backbone. A session manager at the telco central office directs a set of switches to multicast the correct MPEG streams to the field terminals for delivery to subscribers. The efficiency of digital video distribution over a gigabit Ethernet (GigE) network provides enormous potential. A single GigE wavelength can transport 300 DVD quality video programs from a central encoding facility to any number of fiber-connected sites. An additional wavelength dedicated to VOD would enable a single content aggregation point at the regional or national level with nearly real-time distribution to cache/stream servers at the central office. The only video processed at the central office would be local content and over-the-air channels. Compare this to the current cable master headend/primary hub architecture. Delivering 80 analog channels from the headend to the primary hubs using existing digital transport equipment requires five OC-48 wavelengths. This has limited headend consolidation to locations where a cable operator could justify fiber construction between sites. The result is that cable operators must manage multiple downlink and digital encoding sites (master headends) across the country. Operational efficiencies There are several operational efficiencies afforded by the migration to an all-digital product offering. As noted previously, the baseband and IF uncompressed digital transport networks required to move 80 analog channels between the headend and primary hubs could be replaced with a single GigE wavelength that would have enough capacity to support the digital program tier as well. Such a solution could spur headend consolidation, leveraging a single receive and encode facility and a leased GigE wavelength. Additional benefits are found at the system level. If the operator elected to encrypt all digital programs, it could eliminate theft of service. It also could eliminate truck rolls for churn and service changes. Soft disconnects would be a way to manage nonpay customers versus rolling a truck. The modern HFC architecture is designed to carry analog channels. Determining the drive level to a laser and the input levels to an amplifier is a delicate balance between the C/N ratio for the system and the composite second order (CSO) and composite triple beat (CTB) distortions. When this balance is upset, the result is snowy or impaired analog pictures and tiling of the digital pictures. In an all-digital environment the power of each channel is spread evenly across its bandwidth. There is not a carrier where the vast majority of a channel�s power is concentrated. The result is that the network can be re-optimized to provide the best performance for digital channels. The lower distortion component of these channels allows for an improvement in the C/N of the system and better operating margins. The result is fewer truck rolls for quality complaints. Capital savings The largest driver of capital savings for an all-digital product offering is the efficient use of available bandwidth. Between eight and 16 digital channels can be carried in the same spectrum required to support a single analog channel. If in a 450-MHz system 40 channels were dedicated for analog, the migration to an all-digital solution would require a maximum of five channels leaving 35 channels open for new services. The other option to gain this type of capacity is to upgrade the system to 750 MHz (figure 2)

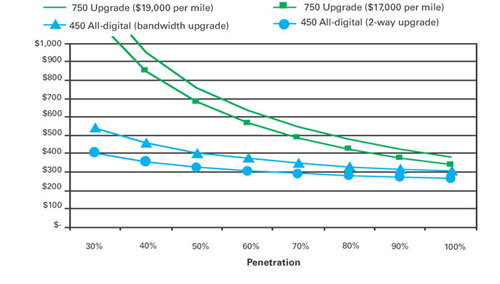

While the initial results of the major telephone companies� FTTP request for proposal focused on an ATM PON solution for voice and data with a more traditional 1,550 wavelength overlay for broadcast video, some other architectures being considered could have substantial operational advantages by leveraging a switched digital video infrastructure converging all services onto a single delivery system. Using this solution, telcos would not need to understand the complexities of RF and baseband video signals, but simply would switch streams to the requesting destination from the central office. (See Figure 1 above.) Content is received, encoded and aggregated onto a fiber distribution system at a regional or national level. It then is delivered to the various central offices as a Moving Picture Experts Group (MPEG) stream over an Internet protocol (IP) or asynchronous transfer mode (ATM) backbone. A session manager at the telco central office directs a set of switches to multicast the correct MPEG streams to the field terminals for delivery to subscribers. The efficiency of digital video distribution over a gigabit Ethernet (GigE) network provides enormous potential. A single GigE wavelength can transport 300 DVD quality video programs from a central encoding facility to any number of fiber-connected sites. An additional wavelength dedicated to VOD would enable a single content aggregation point at the regional or national level with nearly real-time distribution to cache/stream servers at the central office. The only video processed at the central office would be local content and over-the-air channels. Compare this to the current cable master headend/primary hub architecture. Delivering 80 analog channels from the headend to the primary hubs using existing digital transport equipment requires five OC-48 wavelengths. This has limited headend consolidation to locations where a cable operator could justify fiber construction between sites. The result is that cable operators must manage multiple downlink and digital encoding sites (master headends) across the country. Operational efficiencies There are several operational efficiencies afforded by the migration to an all-digital product offering. As noted previously, the baseband and IF uncompressed digital transport networks required to move 80 analog channels between the headend and primary hubs could be replaced with a single GigE wavelength that would have enough capacity to support the digital program tier as well. Such a solution could spur headend consolidation, leveraging a single receive and encode facility and a leased GigE wavelength. Additional benefits are found at the system level. If the operator elected to encrypt all digital programs, it could eliminate theft of service. It also could eliminate truck rolls for churn and service changes. Soft disconnects would be a way to manage nonpay customers versus rolling a truck. The modern HFC architecture is designed to carry analog channels. Determining the drive level to a laser and the input levels to an amplifier is a delicate balance between the C/N ratio for the system and the composite second order (CSO) and composite triple beat (CTB) distortions. When this balance is upset, the result is snowy or impaired analog pictures and tiling of the digital pictures. In an all-digital environment the power of each channel is spread evenly across its bandwidth. There is not a carrier where the vast majority of a channel�s power is concentrated. The result is that the network can be re-optimized to provide the best performance for digital channels. The lower distortion component of these channels allows for an improvement in the C/N of the system and better operating margins. The result is fewer truck rolls for quality complaints. Capital savings The largest driver of capital savings for an all-digital product offering is the efficient use of available bandwidth. Between eight and 16 digital channels can be carried in the same spectrum required to support a single analog channel. If in a 450-MHz system 40 channels were dedicated for analog, the migration to an all-digital solution would require a maximum of five channels leaving 35 channels open for new services. The other option to gain this type of capacity is to upgrade the system to 750 MHz (figure 2) Assuming a constant density of 50 homes per mile, the green lines in Figure 2 (above) represent the cost per customer to upgrade a system to 750 MHz at various penetration levels. The solid green line assumes a $19,000 per mile upgrade cost, while the green line marked with squares assumes a lower upgrade cost of $17,000 per mile. The blue lines in the graph represent the cost per customer to migrate the system to all-digital, assuming a digital set-top cost of $70, a requirement for 2.5 set-tops per home and a $30 installation cost. The blue line marked with circles assumes the system bandwidth is already at 450 MHz, but a $3,000 per mile cost is necessary to activate the return path, install standby power supplies and add a small amount of fiber to segment the plant and reduce cascades. The blue line marked with triangles indicates a cost of $5,000 per mile to upgrade the system. There are significant capital advantages in foregoing a 750 MHz upgrade and instead migrating to an all-digital network in markets currently operating at 450 MHz or below. At 60 percent penetration the cost saving for the 450 MHz all-digital migration versus a 750 MHz upgrade is between $195 and $325 per customer. For a 10,000 homes-passed system this represents a savings of between $1 million and $2 million. Tier 1 system benefits While the most immediate capital benefits of an all-digital migration are for medium-density systems facing the decision to upgrade their network, there are also capital benefits for Tier 1 markets with upgraded plant. Systems operating at 750 MHz also are facing capacity constraints. While node segmentation increases the effective bandwidth per customer available for narrowcast services like VOD, it does not address the need for additional broadcast services such as HDTV. There are four options to gain broadcast bandwidth: Migrating all of the channels allocated for broadcast digital programming to 256-QAM and multiplexing more programs per channels is the simplest solution. This approach, however, only produces five or six channels for launching new services. The cost to obtain this bandwidth is between $15,000 and $20,000 per recovered channel. The variation in cost is dependent on the number of statistical multiplexers already installed and if the existing QAM modulators are 256-QAM capable. Upgrading the system to 860 MHz or 1 GHz is the traditional brute force approach. It produces 18 or 42 new channels, respectively. (figure 3)

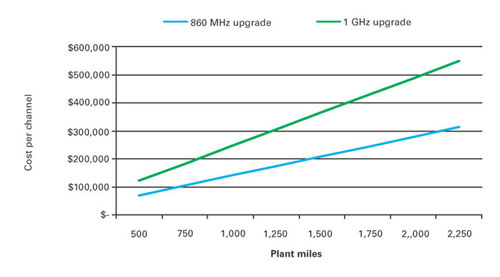

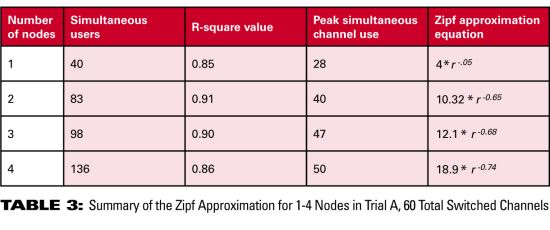

Assuming a constant density of 50 homes per mile, the green lines in Figure 2 (above) represent the cost per customer to upgrade a system to 750 MHz at various penetration levels. The solid green line assumes a $19,000 per mile upgrade cost, while the green line marked with squares assumes a lower upgrade cost of $17,000 per mile. The blue lines in the graph represent the cost per customer to migrate the system to all-digital, assuming a digital set-top cost of $70, a requirement for 2.5 set-tops per home and a $30 installation cost. The blue line marked with circles assumes the system bandwidth is already at 450 MHz, but a $3,000 per mile cost is necessary to activate the return path, install standby power supplies and add a small amount of fiber to segment the plant and reduce cascades. The blue line marked with triangles indicates a cost of $5,000 per mile to upgrade the system. There are significant capital advantages in foregoing a 750 MHz upgrade and instead migrating to an all-digital network in markets currently operating at 450 MHz or below. At 60 percent penetration the cost saving for the 450 MHz all-digital migration versus a 750 MHz upgrade is between $195 and $325 per customer. For a 10,000 homes-passed system this represents a savings of between $1 million and $2 million. Tier 1 system benefits While the most immediate capital benefits of an all-digital migration are for medium-density systems facing the decision to upgrade their network, there are also capital benefits for Tier 1 markets with upgraded plant. Systems operating at 750 MHz also are facing capacity constraints. While node segmentation increases the effective bandwidth per customer available for narrowcast services like VOD, it does not address the need for additional broadcast services such as HDTV. There are four options to gain broadcast bandwidth: Migrating all of the channels allocated for broadcast digital programming to 256-QAM and multiplexing more programs per channels is the simplest solution. This approach, however, only produces five or six channels for launching new services. The cost to obtain this bandwidth is between $15,000 and $20,000 per recovered channel. The variation in cost is dependent on the number of statistical multiplexers already installed and if the existing QAM modulators are 256-QAM capable. Upgrading the system to 860 MHz or 1 GHz is the traditional brute force approach. It produces 18 or 42 new channels, respectively. (figure 3) The blue line in Figure 3 (above) represents a �drop-in� upgrade, using gallium arsenide (GaAs) 860 MHz amplifiers to replace the 750 MHz silicon amplifiers. The assumption is that this upgrade can happen for $2,500 per plant mile. The green line represents a 1 GHz upgrade. This likely would require pushing fiber to a node-plus-one architecture. The model assumes a $10,000 upgrade cost per plant mile. The cost per channel gained is dependent on the number of plant miles. In Tier 1 markets with a significant number of plant miles, a brute force upgrade is likely to be cost prohibitive. Switched digital The migration to a switched digital environment leverages the narrowcast capabilities of the HFC network to distribute to a service group only those channels that are being viewed. Instead of having 17 broadcast digital channels distributing content to all nodes, eight channels could be used to deliver up to 80 channels that are being viewed within a service group. Simple math says that a switched digital video deployment would reclaim nine channels. The operator would eliminate the 17 broadcast digital channels and launch four narrowcast channels in their place. The reality is that switched digital is a paradigm shift for the cable industry. The cost to deploy a switched digital infrastructure is highly dependent on the individual system characteristics. The number of service groups will determine the number of QAM modulators required at the headend and the size of the switch. In addition to the QAM modulator and switch cost there also may be implications to the HFC optical architecture. Narrowcast overlay designs using dense wavelength division multiplexing (DWDM) often have limitations on the number of channels that the narrowcast tier can support. Exceeding these limitations causes signal quality problems on the broadcast tier. When calculating the cost of deploying a switched digital video infrastructure, you must consider any redesign to the HFC optical network that may be needed to increase the number of channels supported per narrowcast group. The operator also must contemplate the overall value of the switched digital environment for HDTV content. As the number of customers with HDTV sets increases, the bandwidth efficiency gained by switching the 13 Mbps programs may not justify the cost of dedicating QAM modulators to each service group versus a single broadcast modulator serving every customer. There may be a point when HDTV penetration reaches a point where popular HD content migrates from switched back to broadcast. There are additional issues with switched digital over a shared HFC network that also must be solved before it can be deployed in mass. At what point can you assume a customer that has requested a stream is no longer watching it and terminate the session? How do you support VCRs� or external DVRs� programmed record settings? What effect does channel surfing have on the session manager and how can this behavior be modeled? Reclaiming analog channels by converting them to digital ultimately could produce 72 channels for new service offerings. A DVD-quality digital encoding rate of 3.75 Mbps enables eight channels to support 80 programs using 256-QAM. Cost analysis The cost to migrate the analog channels to digital has a number of variables and must be calculated for each system. The simple variables include basic penetration and digital penetration; however, a comparison of the digital migration cost to the total cost of a bandwidth upgrade requires considering the system density. (figure 4)

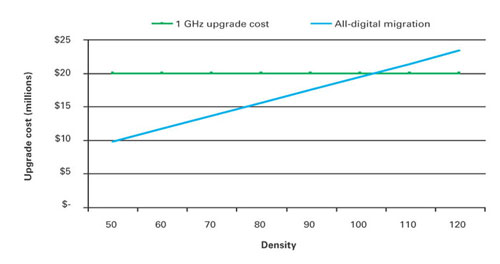

The blue line in Figure 3 (above) represents a �drop-in� upgrade, using gallium arsenide (GaAs) 860 MHz amplifiers to replace the 750 MHz silicon amplifiers. The assumption is that this upgrade can happen for $2,500 per plant mile. The green line represents a 1 GHz upgrade. This likely would require pushing fiber to a node-plus-one architecture. The model assumes a $10,000 upgrade cost per plant mile. The cost per channel gained is dependent on the number of plant miles. In Tier 1 markets with a significant number of plant miles, a brute force upgrade is likely to be cost prohibitive. Switched digital The migration to a switched digital environment leverages the narrowcast capabilities of the HFC network to distribute to a service group only those channels that are being viewed. Instead of having 17 broadcast digital channels distributing content to all nodes, eight channels could be used to deliver up to 80 channels that are being viewed within a service group. Simple math says that a switched digital video deployment would reclaim nine channels. The operator would eliminate the 17 broadcast digital channels and launch four narrowcast channels in their place. The reality is that switched digital is a paradigm shift for the cable industry. The cost to deploy a switched digital infrastructure is highly dependent on the individual system characteristics. The number of service groups will determine the number of QAM modulators required at the headend and the size of the switch. In addition to the QAM modulator and switch cost there also may be implications to the HFC optical architecture. Narrowcast overlay designs using dense wavelength division multiplexing (DWDM) often have limitations on the number of channels that the narrowcast tier can support. Exceeding these limitations causes signal quality problems on the broadcast tier. When calculating the cost of deploying a switched digital video infrastructure, you must consider any redesign to the HFC optical network that may be needed to increase the number of channels supported per narrowcast group. The operator also must contemplate the overall value of the switched digital environment for HDTV content. As the number of customers with HDTV sets increases, the bandwidth efficiency gained by switching the 13 Mbps programs may not justify the cost of dedicating QAM modulators to each service group versus a single broadcast modulator serving every customer. There may be a point when HDTV penetration reaches a point where popular HD content migrates from switched back to broadcast. There are additional issues with switched digital over a shared HFC network that also must be solved before it can be deployed in mass. At what point can you assume a customer that has requested a stream is no longer watching it and terminate the session? How do you support VCRs� or external DVRs� programmed record settings? What effect does channel surfing have on the session manager and how can this behavior be modeled? Reclaiming analog channels by converting them to digital ultimately could produce 72 channels for new service offerings. A DVD-quality digital encoding rate of 3.75 Mbps enables eight channels to support 80 programs using 256-QAM. Cost analysis The cost to migrate the analog channels to digital has a number of variables and must be calculated for each system. The simple variables include basic penetration and digital penetration; however, a comparison of the digital migration cost to the total cost of a bandwidth upgrade requires considering the system density. (figure 4) Figure 4 (above) assumes a 2,000 mile system with 60 percent basic penetration and 35 percent digital penetration. The green line represents the cost to upgrade the system to 1 GHz assuming a $10,000 per mile cost. The blue line represents the cost to migrate the system to all digital by installing 2.5 digital set-tops in every customer�s home. It is not until the system density exceeds 100 homes per mile that the cost to upgrade the system to 1 GHz is a less costly option than the all-digital migration. It is also important to highlight that the 1 GHz upgrade produces 41 channels while the all-digital migration yields 72. Other capital savings accrue from the reduction in house amplifiers. Most cable networks were designed to support three outlets. The introduction of another outlet for cable modems has increased dramatically the number of homes requiring a house amp to provide a minimum of 0 dBmV signal level at the TV. In an all-digital environment, a house amp would not be needed in most situations. There is also a cost premium on digital set-tops for them to be able to process analog video and BTSC stereo. This �analog tax� is currently in the $5 to $9 range for a simple single tuner set-top box. In the case of a digital set-top with an integrated DVR, the cost for analog support increases dramatically. For the set-top to record an analog program, it must contain an MPEG encoder. In a dual tuner set-top with watch-one/record-another capability, a second MPEG encoder is required. The �analog tax� on a dual tuner DVR set-top is currently in the $40 to $50 range. While silicon integration in the next generation of set-top chipsets will reduce this �analog tax,� the cable industry will pay a premium as long as there is a need to support reception of the analog tier on a digital set-top. And while these cost assumptions are based on a simple component-level cost analysis, it is important to note that $50 to $75 dollar digital-only set-tops are being unveiled. Migration strategies There are three strategies to migrate to an all-digital product offering. Each one provides a different level of complication and will yield different benefits when compared against the all-digital drivers. Reclaim analog channels Converting all analog channels to digital will allow the cable operator to take full advantage of operational efficiencies and capital savings. This option provides the largest financial benefit to those operators with low- or medium-density systems in need of upgrade. Operating data collected from Cebridge Connections� Tier 2 markets shows high-speed data is the service that stops customer losses and wins them back from satellite. Markets that were losing customers with only a digital service offering have grown nearly 1 percent since launching high-speed data. Simply offering more content in a digital format slows the loss, but does not stop it. The most glaring challenge to executing this strategy is placing a digital set-top on every outlet of every customer. To achieve a $70 price point, the set-top will have to be a digital-only unit. The migration is more easily managed when segmenting the plant by nodes or trunk runs, and migrating just one section at a time. Reclaim analog over time (table 1)

Figure 4 (above) assumes a 2,000 mile system with 60 percent basic penetration and 35 percent digital penetration. The green line represents the cost to upgrade the system to 1 GHz assuming a $10,000 per mile cost. The blue line represents the cost to migrate the system to all digital by installing 2.5 digital set-tops in every customer�s home. It is not until the system density exceeds 100 homes per mile that the cost to upgrade the system to 1 GHz is a less costly option than the all-digital migration. It is also important to highlight that the 1 GHz upgrade produces 41 channels while the all-digital migration yields 72. Other capital savings accrue from the reduction in house amplifiers. Most cable networks were designed to support three outlets. The introduction of another outlet for cable modems has increased dramatically the number of homes requiring a house amp to provide a minimum of 0 dBmV signal level at the TV. In an all-digital environment, a house amp would not be needed in most situations. There is also a cost premium on digital set-tops for them to be able to process analog video and BTSC stereo. This �analog tax� is currently in the $5 to $9 range for a simple single tuner set-top box. In the case of a digital set-top with an integrated DVR, the cost for analog support increases dramatically. For the set-top to record an analog program, it must contain an MPEG encoder. In a dual tuner set-top with watch-one/record-another capability, a second MPEG encoder is required. The �analog tax� on a dual tuner DVR set-top is currently in the $40 to $50 range. While silicon integration in the next generation of set-top chipsets will reduce this �analog tax,� the cable industry will pay a premium as long as there is a need to support reception of the analog tier on a digital set-top. And while these cost assumptions are based on a simple component-level cost analysis, it is important to note that $50 to $75 dollar digital-only set-tops are being unveiled. Migration strategies There are three strategies to migrate to an all-digital product offering. Each one provides a different level of complication and will yield different benefits when compared against the all-digital drivers. Reclaim analog channels Converting all analog channels to digital will allow the cable operator to take full advantage of operational efficiencies and capital savings. This option provides the largest financial benefit to those operators with low- or medium-density systems in need of upgrade. Operating data collected from Cebridge Connections� Tier 2 markets shows high-speed data is the service that stops customer losses and wins them back from satellite. Markets that were losing customers with only a digital service offering have grown nearly 1 percent since launching high-speed data. Simply offering more content in a digital format slows the loss, but does not stop it. The most glaring challenge to executing this strategy is placing a digital set-top on every outlet of every customer. To achieve a $70 price point, the set-top will have to be a digital-only unit. The migration is more easily managed when segmenting the plant by nodes or trunk runs, and migrating just one section at a time. Reclaim analog over time (table 1) Reclaiming a group of analog channels only as additional bandwidth is required appears to be a solution for systems that are upgraded and the operator is looking for channel capacity to launch more broadcast content. A sample cost calculation to remove the entire analog tier and install digital set-tops in every home is shown in Table 1 (above). A capital expenditure of nearly $11 million is difficult to justify if the operator simply needs six or seven channels for HDTV. The trade-off is that while the channel capacity can be made available by migrating a few analog channels, the operator is not able to achieve any of the benefits of an all-digital solution. (table 2)

Reclaiming a group of analog channels only as additional bandwidth is required appears to be a solution for systems that are upgraded and the operator is looking for channel capacity to launch more broadcast content. A sample cost calculation to remove the entire analog tier and install digital set-tops in every home is shown in Table 1 (above). A capital expenditure of nearly $11 million is difficult to justify if the operator simply needs six or seven channels for HDTV. The trade-off is that while the channel capacity can be made available by migrating a few analog channels, the operator is not able to achieve any of the benefits of an all-digital solution. (table 2) If the system were continuing to grow digital customers against basic penetration and looking to deploy a DVR product tier, having an all-digital solution would provide a quantifiable annual capital savings. (See Table 2 above) Similarly the annual operational savings must also be calculated. (See Table 3 below.) (table 3)

If the system were continuing to grow digital customers against basic penetration and looking to deploy a DVR product tier, having an all-digital solution would provide a quantifiable annual capital savings. (See Table 2 above) Similarly the annual operational savings must also be calculated. (See Table 3 below.) (table 3) If the analysis reveals the capital and operational savings do not justify the migration cost, a staged conversion may be the right approach. The critical exercise is to build the models and identify the triggers that mark when the benefits of an all-digital network will outweigh the costs. Dual-carry analog channels in digital format Another all-digital approach would be to dual-carry the analog channels in both the analog and digital formats. While this approach doesn�t provide all the operational cost savings of reclaiming all analog channels, it does provide the capital savings generated by deploying digital- only set-tops and DVRs. It also will provide the high-end digital customers with a product that could match or exceed satellite�s digital quality advantage. Dual carrying analog channels in a digital format does add to the bandwidth challenge. The operator will need to make available seven or eight channels to duplicate the content. If upgrading the existing digital broadcast channels to 256-QAM does not yield enough capacity, the operator may have to reclaim some of the analog channels and provide them only in the digital tier. The capital savings and benefits of marketing an all-digital solution must be compared against the cost and challenges of providing the necessary bandwidth. Conclusion Competitive, operational and capital benefits can be realized by migrating to all-digital. To remain competitive against satellite and telephony providers, cable operators must take a serious look at this conversion. In part 2 of this series, we�ll look at the challenges facing cable operators as they migrate to all-digital. Don Loheide is vice president of network engineering for Cequel III. Email him at don.loheide@cequel3.com. Nimrod Ben-Natan is director of narrowcast services convergent systems at Harmonic Inc. Email him at nimrod.ben-natan@harmonicinc.com.

If the analysis reveals the capital and operational savings do not justify the migration cost, a staged conversion may be the right approach. The critical exercise is to build the models and identify the triggers that mark when the benefits of an all-digital network will outweigh the costs. Dual-carry analog channels in digital format Another all-digital approach would be to dual-carry the analog channels in both the analog and digital formats. While this approach doesn�t provide all the operational cost savings of reclaiming all analog channels, it does provide the capital savings generated by deploying digital- only set-tops and DVRs. It also will provide the high-end digital customers with a product that could match or exceed satellite�s digital quality advantage. Dual carrying analog channels in a digital format does add to the bandwidth challenge. The operator will need to make available seven or eight channels to duplicate the content. If upgrading the existing digital broadcast channels to 256-QAM does not yield enough capacity, the operator may have to reclaim some of the analog channels and provide them only in the digital tier. The capital savings and benefits of marketing an all-digital solution must be compared against the cost and challenges of providing the necessary bandwidth. Conclusion Competitive, operational and capital benefits can be realized by migrating to all-digital. To remain competitive against satellite and telephony providers, cable operators must take a serious look at this conversion. In part 2 of this series, we�ll look at the challenges facing cable operators as they migrate to all-digital. Don Loheide is vice president of network engineering for Cequel III. Email him at don.loheide@cequel3.com. Nimrod Ben-Natan is director of narrowcast services convergent systems at Harmonic Inc. Email him at nimrod.ben-natan@harmonicinc.com.