Digital Simulcast Deploys

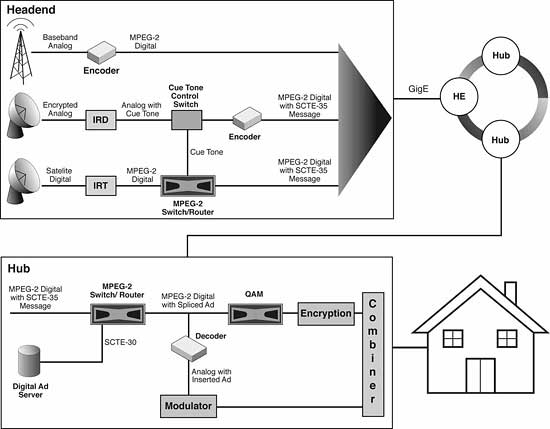

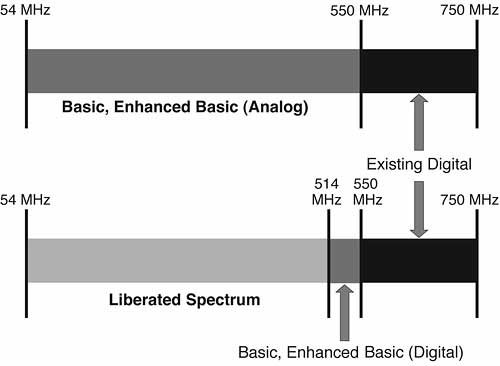

This year digital simulcasts are cropping up like mushrooms after a hard rain. Most of the major MSOs are knee deep in digital simulcast deployments, and the fact that the industry has reacted so quickly in getting the simulcasts up and running serves to underscore how beneficial they are to both customers and cable operators. "A lot of what we have learned is just how quickly this industry can move," says Seth Kenvin, BigBand Networks’ vice president of strategic marketing. "(Digital simulcast is) probably halfway implemented right now, and as we exit the year, it will be more than halfway implemented across the industry. Cox and Charter have already crossed the 50-yard line, and pretty much all of the other major operators are ramping up." "With the growth in HD (high definition), the VoIP (voice over Internet protocol) growth and high-speed data moving up to higher speeds, as well as some other underlying trends, digital simulcast is a pretty amazing initiative that the industry has successfully managed while keeping all of those other balls up in the air." Benefits With more services filling up cable plant capacities, one of the ultimate benefits of digital simulcasts is freeing up bandwidth when the analog channels, in most cases about 80, are digitized. (See Figure 1 for an illustration of this outcome.) That should lead also to reduced costs on equipment such as set-top boxes without analog tuners and decoders. Digital simulcasts also mean cable operators will have an answering parry to the satellite providers’ claims of digital superiority, but the customers also stand to benefit from the digital simulcast growth spurt. "We’re pleased with the feedback from customers on what they’ve been seeing," says John Donahue, Comcast’s senior vice president of engineering and operations. "We haven’t been very vocal about turning them (digital simulcasts) on, but we’ve been monitoring the bulletin boards, and people are noticing them. We’re hearing lots of anecdotal information about how great the pictures look. It’s achieving everything we’ve wanted it to do." Donahue declined to say where Comcast has digital simulcasts up and running, but Comcast expects to have three-quarters of its markets converted to digital simulcasts by the end of the year. Thanks to its Comcast Media Center in Denver, Comcast has a unique approach to digital simulcast. Similar to its Headend in The Sky (HITS) service, Comcast is able use a digital overlay platform for both itself and other cable operators. The overlay platform takes analog channels from a satellite, encodes and grooms them, and then sends them to cable networks for Comcast’s, or other operators’, digital simulcasting. "At some point, if the digital feed isn’t available off of a satellite, you need a digital encoder, and there are costs associated with that," Donahue says. "We encode all of the analog channels in Denver, prepare the multiplexers and then send them to our systems. It’s a very cost-effective approach." It’s also a cost effective approach for smaller cable operators such as Bresnan Communications, which started using the CMC overlay platform in Delta, Utah, in July. "Right now, we’re doing it in very small systems where we’re channel locked and where we need to beef up our programming," says Jim Gemmill, Bresnan’s vice president of operations. "One of the benefits is we don’t have to do a rebuild or upgrade the plant electronics in order to do it. When you carry some of them (analog channels) over basic or expanded basic, you substitute this pod and start carrying them off of the pod. We can reclaim six of those channels, but it costs us one channel to put the pod on, so we end up reclaiming five channels." Lessons learned Donahue said the biggest lesson learned thus far with digital simulcast deployments is to activate the lower viewed services first. "We’ve become rather good at predicting what activity will generate a problem, such as using a frequency we’ve never used before" he says. "By doing this in increments, we can control the activity coming in from a service standpoint, and we can update our techs on what issues to look for." Rogers Cable also took a measured approach when it came to its digital simulcast deployments. "First of all, our network is 860 MHz, so when we started digital simulcast, we were obviously going up higher in the spectrum and using parts of the spectrum we hadn’t used before," says Dermot O’Carroll, Rogers’ senior vice president of engineering and network operations. "What we found is that we ran into some problems with inside wiring and older drops at the higher end of the spectrum. When you’re simulcasting analog, analog channels are still the most watched, so you don’t want to put them at the high end of the spectrum where you may run into difficulties." "We actually mapped the analog up into the 900 series on the guide in case any of our customers ran into difficulties with the digital version. One of our big channels here is CBC (Canadian Broadcasting Corp.) In the analog world, when you tune to channel six, you get CBC; in the digital world, when you tune to channel six, you get a digital CBC. What we did, in case the customers ran into any issues, is we also mapped analog CBC up into the 900 series so they could get the analog signal if they ran into any problems during the transition to digital." Rogers started down the digital simulcast path four years ago as an outgrowth of its need to provide disaster recovery and network redundancy. O’Carroll says Rogers built two digital headends and "digitized all of our content so we could encode all of it ourselves." Rogers made a commitment to closed-loop stat muxing and digitized its analog for a full year before it went digital simulcast. Because Rogers was so far ahead of the simulcast curve, it didn’t have much of a selection from vendors when it came to encoders, decoders and transport mechanisms. But on the other hand, once the network was upgraded two years ago, Rogers only had to add quadrature amplitude modulation (QAM) when it started rolling out digital simulcast in the province of Ontario last year. O’Carroll estimates that 95 percent of Rogers’ digital customers currently have digital simulcast. "The one thing that we did find after going all digital was that you really need a lot of strong processes to maintain the quality of your digital signal," O’Carroll says. "For the past six months, we’ve had a digital task force that has been going back and looking at all of our network, how it’s engineered, how it’s architected. People are going to much larger television screens now, so every artifact in your signal gets amplified on a larger screen. When customers hear ‘digital,’ they’re looking for the quality that comes from digital. The digital signal really has to be pristine." Bruce Marshall, the technical director of Hamilton, Ontario-based Mountain Cable, concurs about shaking down a system prior to a digital simulcast launch. Mountain Cable’s digital simulcast launched in May of last year after an intensive analysis of equipment complexity, quantity of equipment strings and RF active planning. "Clearly the KISS rule (keep it simple, stupid) is important in designing the headend," Marshall says. Mountain Cable took a close look at its headend design to identify single points of failure. "Try to eliminate these points, and if you can’t, harden these points with the installation of redundant power supplies, multiple UPS (uninterruptible power supply) powering and redundant electronics," Marshall says. "In a digital simulcast system, the headend reliability requirement goes up by a factor of 12." Marshall also suggests pre-testing all set-top box software upgrades before sending them out to the masses. He recommended coordinating the software upgrades by set-top box type and starting with the smallest number of installed set-tops. Time Warner Cable divided up its digital simulcast schedule for the company’s first launch in Raleigh, N.C., several months ago. Pat Hourigan, the Raleigh division’s vice president of engineering and technology, said a small portion of Fayetteville went live on June 20, and then the rest on July 6. "Our entire lineup is now 100 percent digital," says Hourigan, whose division has about half a million subscribers. "We real-time encoded all of the analog channels, and there are about 80 of them, individually, but it took close to 200 encoders in our division to make this happen." Ads and audio Among the lessons learned, Hourigan says not to underestimate the time and effort digital ad insertion takes. "I can’t say it wasn’t without a certain amount of trouble, considering we had to do it all in one night, and we have five ad zones with 200 channels of digital ad insertion. It wasn’t insurmountable, and we certainly made it work, but I think looking back we probably thought it would be much easier than it was." (See Figure 2 for a picture of ad insertion over GigE.) Hourigan says getting the audio dialed in for digital simulcast was also a challenge, but hopes that will improve. "It starts with the programmers. We very much hope that all programmers make a conversion to digital in order to provide sources for us that are well-encoded and with equal audio levels for all of them," he says. "We recognize that with local broadcaster bases that we’re going to have to re-encode their product, unless we have direct link, but for all programming services that are on satellites, we’d like to see them all convert to digital. They’re in the process of doing that, but we need to accelerate it." Jeff Riedmiller, Dolby Laboratories’ broadcast product manager, says both programmers and cable technicians need to take the time to understand the dialogue normalization, or dial norm, parameter in Dolby’s AC-3 coding system. "All of the set-top boxes for North America have an AC-3 decoder in them, and it makes gain adjustments based on your down norm value," Riedmiller says. "A lot of people don’t understand the parameters. I can spend an entire day sitting in a room with a PowerPoint (presentation) on math, theory, how to set up the set top boxes, and how the parameters affect the listeners’ experience. It’s a lot to get your head around because the down norm process seems counterintuitive to some." Down the road While the growth spurt of digital simulcast has been a heady one, it has also served to move cable operators further down the road to all-digital networks. "What’s funny is that we’re not talking about the move to all digital," BigBand’s Kenvin says. "It’s going to happen, but it will probably be a fairly gradual thing. I don’t think simulcasting is the end, but it’s proving to be a very worthwhile technique, and it’s an effective way to bridge from one content protocol to another." Mike Robuck is associate editor of Communications Technology. Reach him at mrobuck@accessintel.com. Figure 1  Figure 2

Figure 2