Video Viewing Across All Platforms

The use of streaming video services continues to rise, and people are viewing streaming video entertainment with the expectation that they can access their content whenever, wherever, and on whatever device they want. The increasing diversity of devices on which streaming video is consumed presents a rising challenge for companies seeking to maximize their available market in this highly active and competitive business environment. Doing so requires supporting a varied mix of devices that includes smart TVs, streaming media devices, game consoles, and mobile devices, as well as supporting must-have features such as HDR video and offline download.

Consumers have various connected devices to choose from to access video content, such as smart TVs, streaming media devices, tablets, smartphones, PCs, laptops, and gaming consoles.

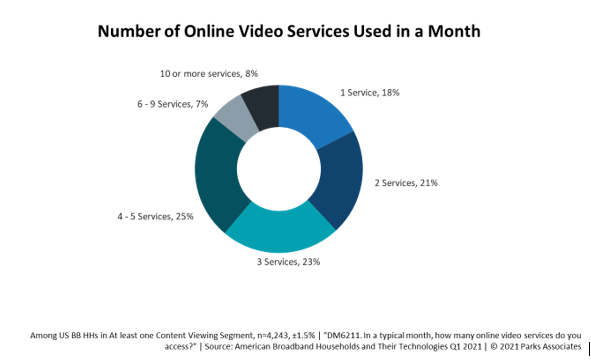

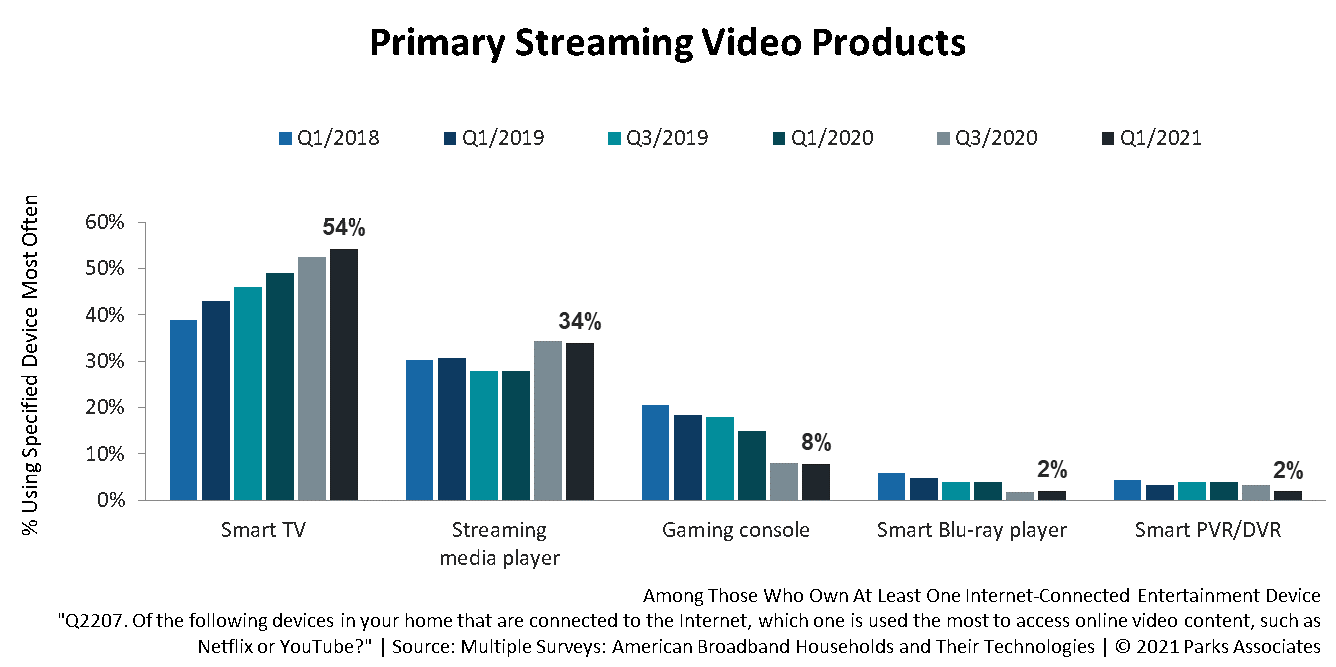

Parks Associates’ research reveals that more than half of US broadband households are now using the smart TV as the device they access most frequently to watch streaming video. Additionally, the firm’s research shows that seventy percent of US broadband households consume streaming video on multiple platforms. As households across the US continue to stay at home, the smart TV has moved to the forefront as the primary device for OTT content, but consumers are watching streaming video on a variety of devices depending on use case, mobility, and location in a household.

A video service seeking to maximize its available market, reach, and related revenue potential needs to support a variety of device types and platforms. Beyond simple maximization of available market, Parks Associates data suggests that broad multiplatform support is a necessity for video services in the current consumer video consumption climate. Thirty-nine percent of broadband households watch video using all platforms: TVs and TV-connected devices, mobile devices, and PCs.

Top Features Driving Consumer Interest

Parks Associates finds that consumers also tend to seek out specific advanced features in their platforms. Of these, 4K and HDR are the two most widely adopted picture-quality technologies and the two greatest “must haves” when it comes to product features. Across both smart TVs and streaming media players, 4K and HDR support were the top two must-have features. When it comes to purchasing devices, consumers’ feature priorities can differ, as Parks Associates data has yielded the following findings.

- Smart TVs – Screen size, brand, and 4K picture quality are key priorities in smart TV purchase considerations.

- Streaming Media Players – Available streaming services, 4K picture quality, and brand are the most significant features for SMP buyers.

- Gaming Consoles – Brand is the dominant factor in console purchase decisions

Support for advanced audio and video quality-of experience features such as Dolby Atmos and Dolby Vision is also increasingly prevalent, as device manufacturers seek ways to add value and avoid commoditization. More importantly, the content sector is increasingly integrating quality-of-experience features such as the above into movie and TV content, to enhance the value and impact of the consumption experience.

Video services need to support these popular capabilities, across all major consumer device platforms, to maximize their potential market and the stickiness of the user experience.

Purchase Intentions

Consumer-reported intention to purchase streaming video products has reached a multi-year high, with the percentage intending to purchase higher than at any tested period in the previous five years. Acceleration of streaming video adoption has also taken place over the same period.

Compared to Q1 2019, Parks Associates’ Q1 2021 data shows distinct increases in consumer purchase intention for all streaming video products. As an example, consumers stating they were likely to purchase a smart TV in the next six months increased from 21% in Q1 2019 to 31% in Q3 2021. For streaming media devices, the rise was even higher, growing from 13% to 25% over the same period.

As streaming video adoption increases, consumers are finding greater value in streaming video devices, and their purchase intentions are rising in lockstep. Given the supply chain constraints that the current semiconductor shortage has caused, pent-up demand is expected to sustain elevated purchase intention for months and possibly a year or more.

For more information on the growth in streaming video adoption and expanding uptake of OTT video services, please download the firm’s complimentary whitepaper in collaboration with Bitmovin. Parks Associates will present consumer research impacting the streaming video market and address key trends and topics affecting the video and connected entertainment industries during its annual Future of Video: OTT, Pay TV, and Digital Media conference. In its fifth year, Future of Video will host virtual sessions February 10, March 10, May 5, July 21, September 22 and in-person sessions in December.

- Paul Erickson is the Director of Research at Parks Associates and Tam Williams serves as a Contributing Analyst. For monthly updates on trends and market activities in the video entertainment space, please visit ParksAssociates.com.